| Zacks Company Profile for Zillow Group, Inc. (ZG : NSDQ) |

|

|

| |

| • Company Description |

| Zillow Group provides real estate and home-related brands on the Web and mobile. The company focuses on home lifecycle which include renting, buying, selling, financing and home improvement. Its portfolio of consumer brands consists of Zillow, Trulia, StreetEasy and HotPads, Naked Apartments, RealEstate.com and OutEast.co. Moreover, Zillow Group offers a complete suite of marketing software and technology solutions to aid real estate, rental, and mortgage professionals make best use of business opportunities and connect with millions of consumers. The company reports results in three segments namely, Internet, Media & Technology or IMT, Homes and Mortgages.

Number of Employees: 7,068 |

|

|

| |

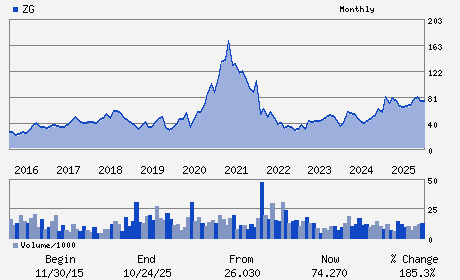

| • Price / Volume Information |

| Yesterday's Closing Price: $44.80 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,617,075 shares |

| Shares Outstanding: 239.93 (millions) |

| Market Capitalization: $10,748.78 (millions) |

| Beta: 2.06 |

| 52 Week High: $90.22 |

| 52 Week Low: $41.90 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-28.02% |

-27.39% |

| 12 Week |

-37.68% |

-37.76% |

| Year To Date |

-34.34% |

-34.66% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jeremy Wacksman - Chief Executive Officer

Lloyd D. Frink - Co-Executive Chairman and President

Richard Barton - Co-Executive Chairman

Jeremy Hofmann - Chief Financial Officer

Jennifer Rock - Chief Accounting Officer

|

|

Peer Information

Zillow Group, Inc. (DFCLQ)

Zillow Group, Inc. (VEL)

Zillow Group, Inc. (CFC)

Zillow Group, Inc. (T.FTI)

Zillow Group, Inc. (CLNH.)

Zillow Group, Inc. (BFSC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-MTG&REL SVS

Sector: Finance

CUSIP: 98954M101

SIC: 7389

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 239.93

Most Recent Split Date: (:1)

Beta: 2.06

Market Capitalization: $10,748.78 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.10 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.72 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 24.83% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |