| Zacks Company Profile for Zions Bancorporation, N.A. (ZION : NSDQ) |

|

|

| |

| • Company Description |

| Zions Bancorporation, National Association is a diversified financial service provider, operating a widespread network. The company spans in many western states: Utah, Idaho, California, Nevada, Arizona, Colorado, Texas, New Mexico, Washington, Oregon and Wyoming. It offers its services through local banking identities using local management teams. The company provides a full range of traditional banking services (both commercial and retail) and is a national leader in small business administration lending, public finance advisory and electronic bond trading. It also offers wealth management and private client banking services. Zions Bancorporation conducts its operations through seven separately managed and branded segments - Zions Bank, Amegy Bank, California Bank & Trust, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado and The Commerce Bank of Washington.

Number of Employees: 9,195 |

|

|

| |

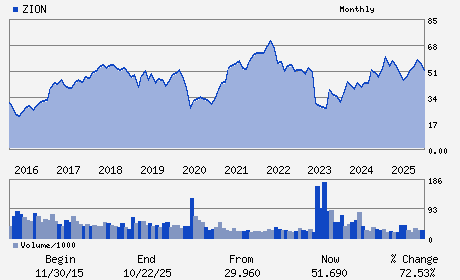

| • Price / Volume Information |

| Yesterday's Closing Price: $57.28 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,063,266 shares |

| Shares Outstanding: 147.89 (millions) |

| Market Capitalization: $8,471.07 (millions) |

| Beta: 0.83 |

| 52 Week High: $66.18 |

| 52 Week Low: $39.32 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-4.39% |

-3.55% |

| 12 Week |

3.30% |

3.17% |

| Year To Date |

-2.15% |

-2.63% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Harris H. Simmons - Chairman and Chief Executive Officer

R. Ryan Richards - Executive Vice President and Chief Financial Off

Jason D. Arbuckle - Controller

Maria Contreras-Sweet - Director

Gary L. Crittenden - Director

|

|

Peer Information

Zions Bancorporation, N.A. (CACB)

Zions Bancorporation, N.A. (CPF)

Zions Bancorporation, N.A. (FMBL)

Zions Bancorporation, N.A. (GRGN.)

Zions Bancorporation, N.A. (EVRT)

Zions Bancorporation, N.A. (EWBC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-WEST

Sector: Finance

CUSIP: 989701107

SIC: 6021

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/20/26

|

|

Share - Related Items

Shares Outstanding: 147.89

Most Recent Split Date: 5.00 (4.00:1)

Beta: 0.83

Market Capitalization: $8,471.07 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.14% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.43 |

Indicated Annual Dividend: $1.80 |

| Current Fiscal Year EPS Consensus Estimate: $6.21 |

Payout Ratio: 0.29 |

| Number of Estimates in the Fiscal Year Consensus: 12.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/12/2026 - $0.45 |

| Next EPS Report Date: 04/20/26 |

|

|

|

| |