| Zacks Company Profile for AAON, Inc. (AAON : NSDQ) |

|

|

| |

| • Company Description |

| Aaon Inc. is a manufacturer of air-conditioning and heating equipment consisting of rooftop units, chillers, air-handling units, condensing units and coils. Its products serve the new construction and replacement markets. The Company has successfully gained market share through its semi-custom product lines, which offer the customer value, quality, function, serviceability and efficiency.

Number of Employees: 4,812 |

|

|

| |

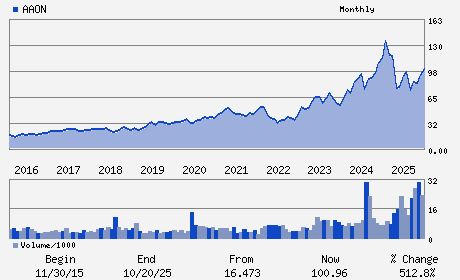

| • Price / Volume Information |

| Yesterday's Closing Price: $101.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 872,902 shares |

| Shares Outstanding: 81.63 (millions) |

| Market Capitalization: $8,261.37 (millions) |

| Beta: 1.09 |

| 52 Week High: $116.04 |

| 52 Week Low: $62.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

11.14% |

12.11% |

| 12 Week |

15.62% |

15.48% |

| Year To Date |

32.72% |

32.08% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Gary D. Fields - Chief Executive Officer and Director

Rebecca A. Thompson - Chief Financial Officer

Norman H. Asbjornson - Director

Angela E. Kouplen - Director

Caron A. Lawhorn - Director

|

|

Peer Information

AAON, Inc. (CCOM.)

AAON, Inc. (MGCLY)

AAON, Inc. (FBIN)

AAON, Inc. (LII)

AAON, Inc. (SPXC)

AAON, Inc. (MTINQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG PRD-AIR/HT

Sector: Construction

CUSIP: 000360206

SIC: 3585

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/02/26

|

|

Share - Related Items

Shares Outstanding: 81.63

Most Recent Split Date: 8.00 (1.50:1)

Beta: 1.09

Market Capitalization: $8,261.37 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.40% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.48 |

Indicated Annual Dividend: $0.40 |

| Current Fiscal Year EPS Consensus Estimate: $1.99 |

Payout Ratio: 0.32 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.08 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/02/26 |

|

|

|

| |