| Zacks Company Profile for Autodesk, Inc. (ADSK : NSDQ) |

|

|

| |

| • Company Description |

| Autodesk develops model-based design, engineering and documentation software. The company serves customers in architecture, engineering and construction; product design and manufacturing; and digital media and entertainment industries. Autodesk recognizes revenue from the sale of product subscriptions, cloud service offerings, and Enterprise Business Agreements, renewal fees for existing maintenance plan agreements that were initially purchased with a perpetual software license, and consulting, training and other goods and services.

Number of Employees: 15,300 |

|

|

| |

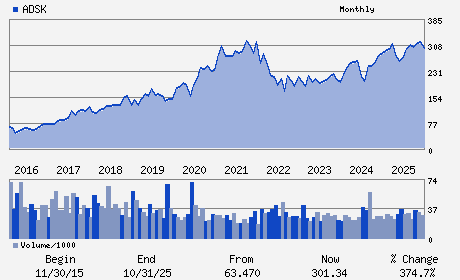

| • Price / Volume Information |

| Yesterday's Closing Price: $245.87 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,579,248 shares |

| Shares Outstanding: 212.00 (millions) |

| Market Capitalization: $52,124.44 (millions) |

| Beta: 1.45 |

| 52 Week High: $329.09 |

| 52 Week Low: $215.01 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.77% |

-1.92% |

| 12 Week |

-19.84% |

-19.94% |

| Year To Date |

-16.94% |

-17.34% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Andrew Anagnost - Chief Executive Officer;President and Director

Steve M. Blum - Executive Vice President and Chief Operating Offic

Janesh Moorjani - Executive Vice President and Chief Financial Offic

Stephen W. Hope - Senior Vice President and Chief Accounting Officer

Stacy J. Smith - Director

|

|

Peer Information

Autodesk, Inc. (ADP)

Autodesk, Inc. (CWLD)

Autodesk, Inc. (CYBA.)

Autodesk, Inc. (ZVLO)

Autodesk, Inc. (AZPN)

Autodesk, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 052769106

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 01/01/26

Next Expected EPS Date: 05/28/26

|

|

Share - Related Items

Shares Outstanding: 212.00

Most Recent Split Date: 12.00 (2.00:1)

Beta: 1.45

Market Capitalization: $52,124.44 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.84 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $8.36 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 11.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 17.03% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/28/26 |

|

|

|

| |