| Zacks Company Profile for Affirm Holdings, Inc. (AFRM : NSDQ) |

|

|

| |

| • Company Description |

| Affirm Holdings is an emerging growth company. They are building the next generation platform for digital and mobile-first commerce. They believe they can reinvent the payment experience. Their platform is comprised of three core elements: a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app.

Number of Employees: 2,206 |

|

|

| |

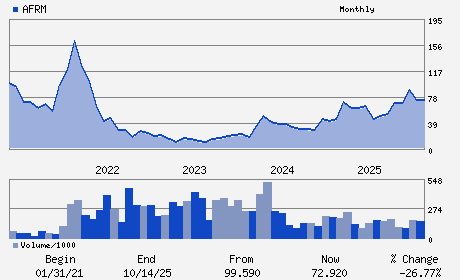

| • Price / Volume Information |

| Yesterday's Closing Price: $46.98 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 8,127,926 shares |

| Shares Outstanding: 333.11 (millions) |

| Market Capitalization: $15,649.55 (millions) |

| Beta: 3.56 |

| 52 Week High: $100.00 |

| 52 Week Low: $30.90 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-25.19% |

-24.21% |

| 12 Week |

-31.61% |

-31.82% |

| Year To Date |

-36.88% |

-32.88% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

650 CALIFORNIA STREET

-

SAN FRANCISCO,CA 94108

USA |

ph: 415-960-1518

fax: - |

ir@affirm.com |

http://www.affirm.com |

|

|

| |

| • General Corporate Information |

Officers

Max Levchin - Chief Executive Officer and Chairman

Libor Michalek - President and Director

Rob O'Hare - Chief Financial Officer

Siphelele Jiyane - Chief Accounting Officer

Richard Galanti - Director

|

|

Peer Information

Affirm Holdings, Inc. (ADP)

Affirm Holdings, Inc. (CWLD)

Affirm Holdings, Inc. (CYBA.)

Affirm Holdings, Inc. (ZVLO)

Affirm Holdings, Inc. (AZPN)

Affirm Holdings, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 00827B106

SIC: 6141

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 333.11

Most Recent Split Date: (:1)

Beta: 3.56

Market Capitalization: $15,649.55 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.18 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.11 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 24.52% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |