| Zacks Company Profile for C3.ai, Inc. (AI : NYSE) |

|

|

| |

| • Company Description |

| C3.ai Inc. is an enterprise AI software provider for accelerating digital transformation. C3.ai delivers the C3 AI Suite for developing, deploying and operating large-scale AI, predictive analytics and IoT applications. The core of the C3.ai offering is a proprietary, model-driven AI architecture which enhances data science and application development. C3.ai is based in Redwood City, United States.

Number of Employees: 1,181 |

|

|

| |

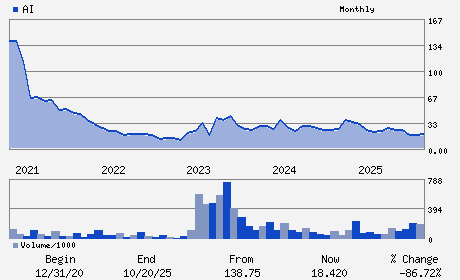

| • Price / Volume Information |

| Yesterday's Closing Price: $7.95 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 8,106,463 shares |

| Shares Outstanding: 140.75 (millions) |

| Market Capitalization: $1,118.99 (millions) |

| Beta: 1.98 |

| 52 Week High: $30.24 |

| 52 Week Low: $7.73 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-35.16% |

-34.31% |

| 12 Week |

-48.11% |

-48.27% |

| Year To Date |

-41.02% |

-38.26% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1400 Seaport Blvd

-

Redwood City,CA 94063

USA |

ph: 650-503-2200

fax: - |

ir@c3.ai |

http://www.c3.ai |

|

|

| |

| • General Corporate Information |

Officers

Thomas M. Siebel - Chief Executive Officer and Chairman of the Board

Hitesh Lath - Senior Vice President and Chief Financial Officer

Lisa A. Davis - Director

Richard C. Levin - Director

Michael G. McCaffery - Director

|

|

Peer Information

C3.ai, Inc. (UIS)

C3.ai, Inc. (CTSH)

C3.ai, Inc. (ASGN)

C3.ai, Inc. (GTTNQ)

C3.ai, Inc. (DXC)

C3.ai, Inc. (DOX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: IT Services

Sector: Computer and Technology

CUSIP: 12468P104

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: April

Last Reported Quarter: 01/01/26

Next Expected EPS Date: 05/27/26

|

|

Share - Related Items

Shares Outstanding: 140.75

Most Recent Split Date: (:1)

Beta: 1.98

Market Capitalization: $1,118.99 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.73 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-3.05 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/27/26 |

|

|

|

| |