| Zacks Company Profile for Alstom ADR (ALSMY : OTC) |

|

|

| |

| • Company Description |

| Alstom SA develops and markets systems, equipment and services for the railway sector. Its product includes bogies, traction systems, electrification, track laying and urban integrated solution. It also offers services such as parts and repairs, maintenance, customisation, modernisation and support services. Alstom SA is headquartered in France.

Number of Employees: 86,039 |

|

|

| |

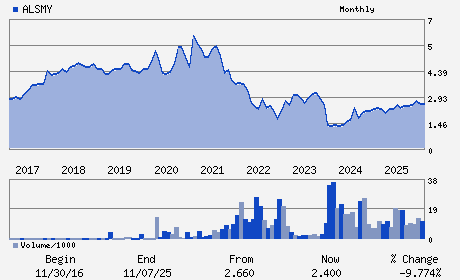

| • Price / Volume Information |

| Yesterday's Closing Price: $3.29 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 499,026 shares |

| Shares Outstanding: 4,620.30 (millions) |

| Market Capitalization: $15,200.79 (millions) |

| Beta: 1.32 |

| 52 Week High: $3.51 |

| 52 Week Low: $1.80 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.78% |

5.69% |

| 12 Week |

24.62% |

24.47% |

| Year To Date |

13.06% |

12.51% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Henri Poupart-Lafarge - Chief Executive Officer and Director

Danny Di Perna - Executive VP & COO

Bernard-Pierre Delpit - Executive VP & CFO

Ms. Dana Salloum - Chief Communications Officer

Emmanuelle Petrovic - General Counsel

|

|

Peer Information

Alstom ADR (ABCRQ)

Alstom ADR (RVSN)

Alstom ADR (CP)

Alstom ADR (FLA)

Alstom ADR (GSHHY)

Alstom ADR (BNI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-RAIL

Sector: Transportation

CUSIP: 021244207

SIC: 3621

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 4,620.30

Most Recent Split Date: (:1)

Beta: 1.32

Market Capitalization: $15,200.79 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.19 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |