| Zacks Company Profile for Air Products and Chemicals, Inc. (APD : NYSE) |

|

|

| |

| • Company Description |

| Air Products and Chemicals Inc. makes industrial gases as well as a variety of polymer and performance chemicals. It also supplies processing equipment. Air Products' reporting segments are as follows: Industrial Gases - Americas, Industrial Gases Europe, Middle East, and Africa/EMEA and Industrial Gases Asia segments include the results of the company's regional industrial gases businesses. These businesses sell atmospheric gases such as oxygen, nitrogen and argon and processes gases to a number of industries. Process gases such as carbon dioxide, helium, hydrogen, etc. are produced by other methods that exclude air separation. The largest cost component of the atmospheric gases is electricity. The Industrial Gases Global division designs and manufactures cryogenic and gas-processing equipment for air separation. The Corporate and other segment includes Air Products' liquefied natural gas sale of equipment business and helium storage and distribution vessel sale of equipment business.

Number of Employees: 21,300 |

|

|

| |

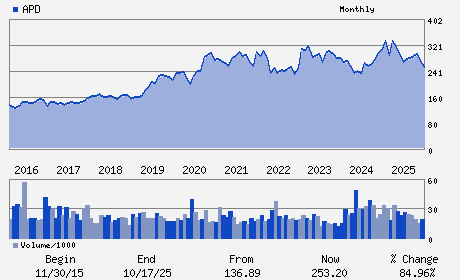

| • Price / Volume Information |

| Yesterday's Closing Price: $275.67 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,444,736 shares |

| Shares Outstanding: 222.66 (millions) |

| Market Capitalization: $61,379.59 (millions) |

| Beta: 0.88 |

| 52 Week High: $321.47 |

| 52 Week Low: $229.11 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.16% |

2.05% |

| 12 Week |

5.75% |

5.62% |

| Year To Date |

11.60% |

11.06% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Eduardo F. Menezes - Chief Executive Officer and Director

Melissa N. Schaeffer - ExecutiveVicePresidentandChiefFinancialOfficer

William J. Pellicciotti - Vice President; Controller and Chief Accounting Of

Tonit M. Calaway - Director

Lisa A. Davis - Director

|

|

Peer Information

Air Products and Chemicals, Inc. (ENFY)

Air Products and Chemicals, Inc. (EMLIF)

Air Products and Chemicals, Inc. (GPLB)

Air Products and Chemicals, Inc. (BCPUQ)

Air Products and Chemicals, Inc. (CYT.)

Air Products and Chemicals, Inc. (SOA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-DIVERSIFD

Sector: Basic Materials

CUSIP: 009158106

SIC: 2810

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 222.66

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.88

Market Capitalization: $61,379.59 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.60% |

| Current Fiscal Quarter EPS Consensus Estimate: $3.04 |

Indicated Annual Dividend: $7.16 |

| Current Fiscal Year EPS Consensus Estimate: $13.01 |

Payout Ratio: 0.58 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: -0.04 |

| Estmated Long-Term EPS Growth Rate: 7.84% |

Last Dividend Paid: 01/02/2026 - $1.79 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |