| Zacks Company Profile for Avnet, Inc. (AVT : NSDQ) |

|

|

| |

| • Company Description |

| Avnet Inc. is one of the world's largest distributors of electronic components and computer products. It serves original equipment manufacturers, electronic manufacturing services providers, original design manufacturers, and value-added resellers. Avnet maintains an extensive inventory, including electronic products and system manufacturers. Avnet distributes products for companies like IBM and Hewlett-Packard Co. Avnet has two major operating segments: Electronic Components (EC) & Premier Farnell (PF). The EC unit distributes semiconductors and Interconnect, passive and electromechanical devices, and provides supply chain management, inventory replenishment system and non-complex engineering design services and integrated solutions like technical design, integration and assembly of embedded products, systems and solutions for industrial applications. Avnet's PF unit provides a comprehensive suite of kits, tools, electronic components and industrial automation components to both engineers and entrepreneurs.

Number of Employees: 14,869 |

|

|

| |

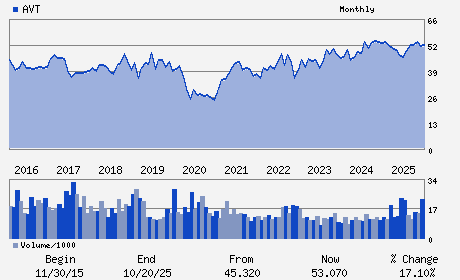

| • Price / Volume Information |

| Yesterday's Closing Price: $65.84 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,264,284 shares |

| Shares Outstanding: 81.86 (millions) |

| Market Capitalization: $5,389.86 (millions) |

| Beta: 0.93 |

| 52 Week High: $68.29 |

| 52 Week Low: $39.22 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.94% |

6.32% |

| 12 Week |

34.01% |

33.59% |

| Year To Date |

36.94% |

36.32% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Philip R. Gallagher - Chief Executive Officer and Director

Rodney C. Adkins - Chair of the Board and Director

Kenneth A. Jacobson - Chief Financial Officer

Brenda L. Freeman - Director

Helmut Gassel - Director

|

|

Peer Information

Avnet, Inc. (RELL)

Avnet, Inc. (AXE)

Avnet, Inc. (NUHC)

Avnet, Inc. (ARW)

Avnet, Inc. (WCC)

Avnet, Inc. (NVNXF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC PARTS DIST

Sector: Computer and Technology

CUSIP: 053807103

SIC: 5065

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 81.86

Most Recent Split Date: 9.00 (2.00:1)

Beta: 0.93

Market Capitalization: $5,389.86 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.13% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.33 |

Indicated Annual Dividend: $1.40 |

| Current Fiscal Year EPS Consensus Estimate: $4.62 |

Payout Ratio: 0.40 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.14 |

| Estmated Long-Term EPS Growth Rate: 29.15% |

Last Dividend Paid: 12/03/2025 - $0.35 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |