| Zacks Company Profile for BARINGS BDC, INC. (BBDC : NYSE) |

|

|

| |

| • Company Description |

| Barings BDC, Inc. is an externally managed business development company which primarily makes debt investments in middle market companies. The company is primarily managed by Barings, LLC, a premier global asset manager. Barings BDC Inc., formerly known as TRIANGLE CAPITAL CORPORATION, is based in Charlotte, United States.

Number of Employees: |

|

|

| |

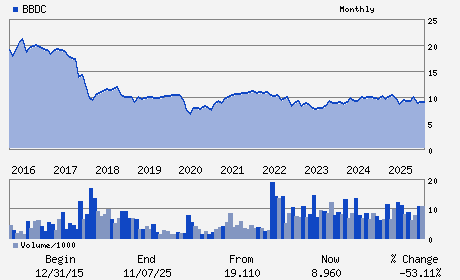

| • Price / Volume Information |

| Yesterday's Closing Price: $8.44 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 903,639 shares |

| Shares Outstanding: 104.71 (millions) |

| Market Capitalization: $883.73 (millions) |

| Beta: 0.60 |

| 52 Week High: $10.58 |

| 52 Week Low: $7.66 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-7.15% |

-6.34% |

| 12 Week |

-4.85% |

-4.97% |

| Year To Date |

-8.06% |

-8.51% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Thomas Q. McDonnell - Chief Executive Officer

Eric Lloyd - Executive Chairman

Elizabeth A. Murray - Chief Financial Officer and Chief Operating Offic

Rosa J. Epperson - Chief Accounting Officer

Valerie Lancaster-Beal - Director

|

|

Peer Information

BARINGS BDC, INC. (AVCP)

BARINGS BDC, INC. (FNVG)

BARINGS BDC, INC. (MFIN)

BARINGS BDC, INC. (RAND)

BARINGS BDC, INC. (SFES)

BARINGS BDC, INC. (ACAS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-SBIC&COMMRL

Sector: Finance

CUSIP: 06759L103

SIC: 6282

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 104.71

Most Recent Split Date: (:1)

Beta: 0.60

Market Capitalization: $883.73 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 12.32% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.25 |

Indicated Annual Dividend: $1.04 |

| Current Fiscal Year EPS Consensus Estimate: $0.97 |

Payout Ratio: 0.93 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/03/2025 - $0.26 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |