| Zacks Company Profile for BridgeBio Pharma, Inc. (BBIO : NSDQ) |

|

|

| |

| • Company Description |

| BridgeBio Pharma Inc. is a new type of biopharmaceutical company founded to discover, create, test, and deliver transformative medicines to treat patients who suffer from genetic diseases. BridgeBio Pharma Inc. is based in PALO ALTO, Calif.

Number of Employees: 839 |

|

|

| |

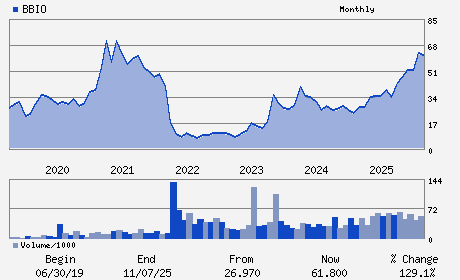

| • Price / Volume Information |

| Yesterday's Closing Price: $66.48 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,471,899 shares |

| Shares Outstanding: 193.86 (millions) |

| Market Capitalization: $12,888.00 (millions) |

| Beta: 1.13 |

| 52 Week High: $84.94 |

| 52 Week Low: $28.33 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-13.96% |

-13.21% |

| 12 Week |

-9.72% |

-9.83% |

| Year To Date |

-13.09% |

-13.51% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

3160 PORTER DR. SUITE 250

-

PALO ALTO,CA 94304

USA |

ph: 650-391-9740

fax: - |

None |

http://www.bridgebio.com |

|

|

| |

| • General Corporate Information |

Officers

Neil Kumar - Chief Executive Officer; Director

Thomas Trimarchi - President; Chief Financial Officer

Maricel M. Apuli - Chief Accounting Officer

Eric Aguiar - Director

Jennifer E. Cook - Director

|

|

Peer Information

BridgeBio Pharma, Inc. (BGMR)

BridgeBio Pharma, Inc. (MGX)

BridgeBio Pharma, Inc. (IPAH)

BridgeBio Pharma, Inc. (BRL)

BridgeBio Pharma, Inc. (BHC)

BridgeBio Pharma, Inc. (AKRXQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-GENERIC DRG

Sector: Medical

CUSIP: 10806X102

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 193.86

Most Recent Split Date: (:1)

Beta: 1.13

Market Capitalization: $12,888.00 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.66 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-1.80 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 12.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 48.36% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |