| Zacks Company Profile for Bath & Body Works, Inc. (BBWI : NYSE) |

|

|

| |

| • Company Description |

| Bath & Body Works is a specialty retailers and home to America's Favorite Fragrances(R) offering exclusive fragrances for the body and home, fragrance mist, body lotion and body cream, 3-wick candles, home fragrance diffusers and liquid hand soap. Bath & Body Works, formerly known as L BRANDS INC, is based in COLUMBUS, Ohio.

Number of Employees: 59,210 |

|

|

| |

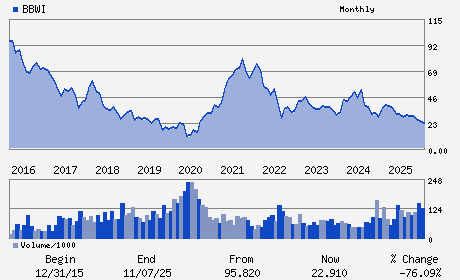

| • Price / Volume Information |

| Yesterday's Closing Price: $22.76 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,786,139 shares |

| Shares Outstanding: 204.72 (millions) |

| Market Capitalization: $4,659.46 (millions) |

| Beta: 1.48 |

| 52 Week High: $37.29 |

| 52 Week Low: $14.28 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.40% |

5.32% |

| 12 Week |

20.87% |

20.72% |

| Year To Date |

13.35% |

12.80% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Gina R. Boswell - Chief Executive Officer

Sarah E. Nash - Chairman

Eva C. Boratto - Chief Financial Officer

Alessandro Bogliolo - Director

Lucy O. Brady - Director

|

|

Peer Information

Bath & Body Works, Inc. (COCQ)

Bath & Body Works, Inc. (JAS)

Bath & Body Works, Inc. (JAS.B)

Bath & Body Works, Inc. (HKFIQ)

Bath & Body Works, Inc. (CNJ)

Bath & Body Works, Inc. (T.CTC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-MISC/DIV

Sector: Retail/Wholesale

CUSIP: 070830104

SIC: 5990

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/04/26

|

|

Share - Related Items

Shares Outstanding: 204.72

Most Recent Split Date: 5.00 (2.00:1)

Beta: 1.48

Market Capitalization: $4,659.46 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.51% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.28 |

Indicated Annual Dividend: $0.80 |

| Current Fiscal Year EPS Consensus Estimate: $2.43 |

Payout Ratio: 0.24 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.05 |

| Estmated Long-Term EPS Growth Rate: 9.32% |

Last Dividend Paid: 02/20/2026 - $0.20 |

| Next EPS Report Date: 03/04/26 |

|

|

|

| |