| Zacks Company Profile for BCB Bancorp, Inc. (NJ) (BCBP : NSDQ) |

|

|

| |

| • Company Description |

| BCB Bancorp, Inc. operates as the holding company for BCB Community Bank, a state chartered commercial bank that provides banking products and services to businesses and individuals in the United States. The Bank is a community-oriented financial institution. Its business is to offer Federal Deposit Insurance Corporation (FDIC)-insured deposit products and to invest funds held in deposit accounts at the Bank, together with funds generated from operations, in loans and investment securities. The company offers deposit products, including savings and club accounts, interest and non-interest bearing demand accounts, money market accounts, certificates of deposit, individual retirement accounts, and term certificate accounts. In addition, the company offers retail and commercial banking services comprising wire transfers, money orders, safe deposit boxes, night depository services, debit cards, online and mobile banking services, gift cards, fraud detection services, and automated teller services.

Number of Employees: 316 |

|

|

| |

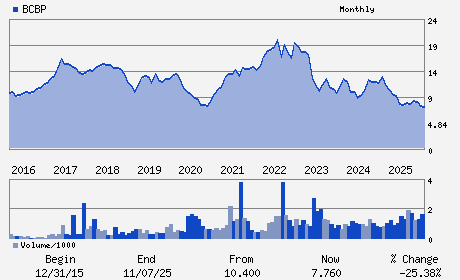

| • Price / Volume Information |

| Yesterday's Closing Price: $8.00 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 99,603 shares |

| Shares Outstanding: 17.23 (millions) |

| Market Capitalization: $137.83 (millions) |

| Beta: 0.74 |

| 52 Week High: $10.38 |

| 52 Week Low: $7.31 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.39% |

2.28% |

| 12 Week |

-0.74% |

-0.87% |

| Year To Date |

-0.87% |

-1.35% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael A. Shriner - President; Chief Executive Officer

Mark D. Hogan - Chairman

Jawad Chaudhry - Chief Financial Officer

Thomas Coughlin - Director

Vincent DiDomenico, Jr. - Director

|

|

Peer Information

BCB Bancorp, Inc. (NJ) (CNBKA)

BCB Bancorp, Inc. (NJ) (CNBI2)

BCB Bancorp, Inc. (NJ) (CNOB)

BCB Bancorp, Inc. (NJ) (FBNK.)

BCB Bancorp, Inc. (NJ) (FMBN)

BCB Bancorp, Inc. (NJ) (TBNK)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-NORTHEAST

Sector: Finance

CUSIP: 055298103

SIC: 6035

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/28/26

|

|

Share - Related Items

Shares Outstanding: 17.23

Most Recent Split Date: (:1)

Beta: 0.74

Market Capitalization: $137.83 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.25 |

Indicated Annual Dividend: $0.32 |

| Current Fiscal Year EPS Consensus Estimate: $1.12 |

Payout Ratio: 12.80 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 11.46 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/11/2026 - $0.08 |

| Next EPS Report Date: 04/28/26 |

|

|

|

| |