| Zacks Company Profile for Brink's Company (The) (BCO : NYSE) |

|

|

| |

| • Company Description |

| The Brink?s Company is the global leader in total cash management, secure route-based logistics and payment solutions including cash-in-transit, ATM services, cash management services (including vault outsourcing, money processing and intelligent safe services), and international transportation of valuables. Their customers include financial institutions, retailers, government agencies, mints, jewelers and other commercial operations. Their global network of operations in 41 countries serves customers in more than 100 countries.

Number of Employees: 65,400 |

|

|

| |

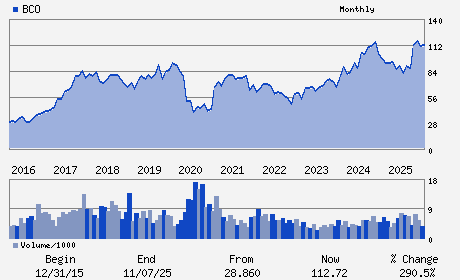

| • Price / Volume Information |

| Yesterday's Closing Price: $116.77 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 421,537 shares |

| Shares Outstanding: 41.15 (millions) |

| Market Capitalization: $4,805.38 (millions) |

| Beta: 1.09 |

| 52 Week High: $136.37 |

| 52 Week Low: $80.10 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-8.08% |

-7.28% |

| 12 Week |

0.07% |

-0.05% |

| Year To Date |

0.03% |

-0.45% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1801 BAYBERRY COURT

-

RICHMOND,VA 23226

USA |

ph: 804-289-9600

fax: 804-289-9770 |

None |

http://www.brinksglobal.com |

|

|

| |

| • General Corporate Information |

Officers

Mark Eubanks - President and Chief Executive Officer

Kurt B. McMaken - Executive Vice President and Chief Financial Offic

Kristen Cook - Executive Vice President; Chief Legal Officer and

Kathie J. Andrade - Director

Paul G. Boynton - Director

|

|

Peer Information

Brink's Company (The) (FISV)

Brink's Company (The) (USIO)

Brink's Company (The) (EEFT)

Brink's Company (The) (PAR)

Brink's Company (The) (RBA)

Brink's Company (The) (OPAY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Financial Transaction Services

Sector: Business Services

CUSIP: 109696104

SIC: 4731

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/11/26

|

|

Share - Related Items

Shares Outstanding: 41.15

Most Recent Split Date: (:1)

Beta: 1.09

Market Capitalization: $4,805.38 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.87% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.63 |

Indicated Annual Dividend: $1.02 |

| Current Fiscal Year EPS Consensus Estimate: $8.91 |

Payout Ratio: 0.13 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/02/2026 - $0.25 |

| Next EPS Report Date: 05/11/26 |

|

|

|

| |