| Zacks Company Profile for Builders FirstSource, Inc. (BLDR : NYSE) |

|

|

| |

| • Company Description |

| Builders FirstSource is the largest U.S supplier of building products, prefabricated components, and value-added services to the professional market segment for new residential construction and repair and remodeling. The company provides customers with an integrated home-building solution, offering manufacturing, supply, delivery and installation of a full range of structural and related building products. The company's nationwide team is equipped with the talent, local knowledge and industry expertise required to solve home-building challenges and streamline customers' business. The company is also investing in tomorrow - continuously improving the business, strengthening the team and creating the next generation of breakthrough innovations that are transforming the home-building industry. Builders FirstSource has a nationwide network of distribution and manufacturing facilities that combine local expertise with national scale to consistently deliver what and when the customers need.

Number of Employees: 28,000 |

|

|

| |

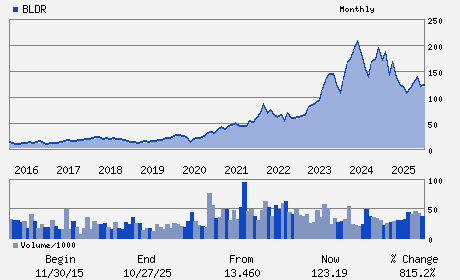

| • Price / Volume Information |

| Yesterday's Closing Price: $104.29 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,310,742 shares |

| Shares Outstanding: 110.61 (millions) |

| Market Capitalization: $11,535.00 (millions) |

| Beta: 1.56 |

| 52 Week High: $151.03 |

| 52 Week Low: $94.35 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-8.84% |

-8.04% |

| 12 Week |

-5.20% |

-5.32% |

| Year To Date |

1.36% |

0.87% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Peter M. Jackson - Chief Executive Officer and Director

Paul S. Levy - Chairman and Director

Pete R. Beckmann - Executive Vice President and Chief Financial Offic

Matthew Trester - Vice President and Controller

Mark Alexander - Director

|

|

Peer Information

Builders FirstSource, Inc. (DHMS)

Builders FirstSource, Inc. (GMS)

Builders FirstSource, Inc. (NHCI)

Builders FirstSource, Inc. (HBP)

Builders FirstSource, Inc. (NOLD)

Builders FirstSource, Inc. (JCTC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG PRD-RT/WHL

Sector: Retail/Wholesale

CUSIP: 12008R107

SIC: 5211

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 110.61

Most Recent Split Date: (:1)

Beta: 1.56

Market Capitalization: $11,535.00 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.45 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $5.85 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 7.08% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |