| Zacks Company Profile for Braze, Inc. (BRZE : NSDQ) |

|

|

| |

| • Company Description |

| Braze Inc. provide comprehensive customer engagement platform which powers interactions between consumers and brands. The company can ingest and process customer data in real time, orchestrate and optimize contextually relevant, cross-channel marketing campaigns and continuously evolve their customer engagement strategies. It operates principally in Berlin, Chicago, London, San Francisco, Singapore and Tokyo. Braze Inc. is headquartered in New York.

Number of Employees: 1,699 |

|

|

| |

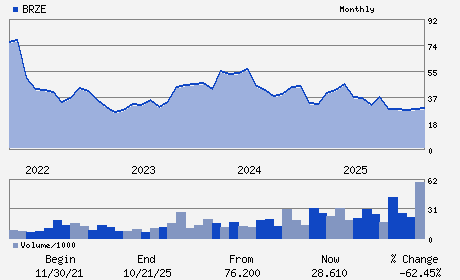

| • Price / Volume Information |

| Yesterday's Closing Price: $18.99 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,630,549 shares |

| Shares Outstanding: 112.21 (millions) |

| Market Capitalization: $2,130.97 (millions) |

| Beta: 1.08 |

| 52 Week High: $43.89 |

| 52 Week Low: $15.26 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-8.79% |

-7.99% |

| 12 Week |

-37.33% |

-37.40% |

| Year To Date |

-44.62% |

-44.89% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

63 MADISON BUILDING 28 EAST 28TH STREET FLOOR 12

-

NEW YORK,NY 10016

USA |

ph: 609-964-0585

fax: - |

ir@braze.com |

http://www.braze.com |

|

|

| |

| • General Corporate Information |

Officers

William Magnuson - Chief Executive Officer and Director

Isabelle Winkles - Chief Financial Officer

Pankaj Malik - Chief Accounting Officer

Neeraj Agrawal - Director

Phillip M. Fernandez - Director

|

|

Peer Information

Braze, Inc. (ADP)

Braze, Inc. (CWLD)

Braze, Inc. (CYBA.)

Braze, Inc. (ZVLO)

Braze, Inc. (AZPN)

Braze, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 10576N102

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/26/26

|

|

Share - Related Items

Shares Outstanding: 112.21

Most Recent Split Date: (:1)

Beta: 1.08

Market Capitalization: $2,130.97 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.22 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.77 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 30.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/26/26 |

|

|

|

| |