| Zacks Company Profile for Banco Santander Brasil SA (BSBR : NYSE) |

|

|

| |

| • Company Description |

| Banco Santander, S.A. is a retail and commercial bank. The Banks segments include Continental Europe, the United Kingdom, Latin America and the United States. The Continental Europe segment covers all businesses in the Continental Europe. The United Kingdom segment includes the businesses developed by various units and branches in the country. The Latin America segment embraces all its financial activities conducted through its banks and subsidiaries in the region. The United States segment includes the Intermediate Holding Company (IHC) and its subsidiaries Santander Bank, Banco Santander Puerto Rico, Santander Consumer USA, Banco Santander International, Santander Investment Securities, and the Santander branch in New York. The Company's commercial model satisfies the needs of all types of customers: individuals with various income levels.

Number of Employees: 55,646 |

|

|

| |

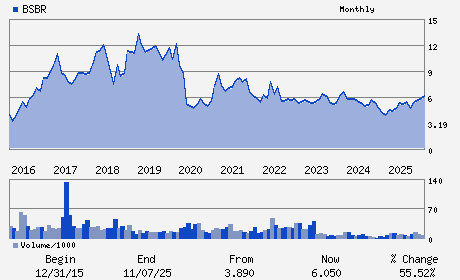

| • Price / Volume Information |

| Yesterday's Closing Price: $6.51 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 911,359 shares |

| Shares Outstanding: 3,729.81 (millions) |

| Market Capitalization: $24,281.09 (millions) |

| Beta: 0.60 |

| 52 Week High: $7.32 |

| 52 Week Low: $4.26 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.92% |

-5.10% |

| 12 Week |

6.72% |

6.59% |

| Year To Date |

6.55% |

6.03% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

AV. JUSCELINO KUBITSCHEK 2041 AND 2235

-

SAO PAULO SP,D5 04543-011

BRA |

ph: 55-11-3174-8589

fax: 55-11-3553-7797 |

None |

http://www.santander.com.br |

|

|

| |

| • General Corporate Information |

Officers

Mario Roberto Opice Leao - Chief Executive Officer

Deborah Stern Vieitas - Independent Chairwoman

Javier Maldonado Trinchant - Vice Chairman

Gustavo Alejo Viviani - Vice President Executive Officer and Investor Rela

Alessandro Tomao - Vice President Executive Officer

|

|

Peer Information

Banco Santander Brasil SA (BKAU)

Banco Santander Brasil SA (BKEAY)

Banco Santander Brasil SA (BKNIY)

Banco Santander Brasil SA (BKJAY)

Banco Santander Brasil SA (ABNYY)

Banco Santander Brasil SA (BNSTY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-FOREIGN

Sector: Finance

CUSIP: 05967A107

SIC: 6029

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 3,729.81

Most Recent Split Date: (:1)

Beta: 0.60

Market Capitalization: $24,281.09 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.11% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.63 |

Indicated Annual Dividend: $0.27 |

| Current Fiscal Year EPS Consensus Estimate: $0.87 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 10.28% |

Last Dividend Paid: 01/22/2026 - $0.09 |

| Next EPS Report Date: - |

|

|

|

| |