| Zacks Company Profile for Conagra Brands (CAG : NYSE) |

|

|

| |

| • Company Description |

| Conagra Brands, Inc. is one of the leading branded food company of North America. The company offers premium edible products, with refined focus on innovation.The company maintains a highly dynamic product portfolio and incorporates alterations within it as per the preference pattern of the end-users. Some iconic brands of the company are Reddi-Wip, Hunt's, Healthy Choice, Frontera, Slim Jim, Blake's and Marie Callender. Conagra currently reports results in the following segments: Grocery & Snacks, Refrigerated & Frozen, International, and Foodservice.

Number of Employees: 18,300 |

|

|

| |

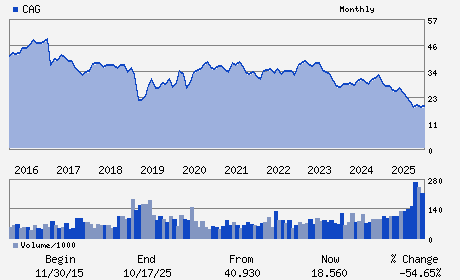

| • Price / Volume Information |

| Yesterday's Closing Price: $19.25 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 12,968,968 shares |

| Shares Outstanding: 478.37 (millions) |

| Market Capitalization: $9,208.61 (millions) |

| Beta: -0.02 |

| 52 Week High: $28.52 |

| 52 Week Low: $15.96 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.00% |

4.91% |

| 12 Week |

12.90% |

12.76% |

| Year To Date |

11.21% |

10.67% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

222 W. MERCHANDISE MART PLAZA SUITE 1300

-

CHICAGO,IL 60654

USA |

ph: 312-549-5000

fax: 402-595-4709 |

ir@conagra.com |

http://www.conagrabrands.com |

|

|

| |

| • General Corporate Information |

Officers

Sean M. Connolly - President and Chief Executive Officer

Thomas M. McGough - Executive Vice President and Chief Operating Offic

David S. Marberger - Executive Vice President and Chief Financial Offic

Carey L. Bartell - Executive Vice President; General Counsel and Corp

William E. Johnson - Senior Vice President and Corporate Controller

|

|

Peer Information

Conagra Brands (CDSCY)

Conagra Brands (HDNHY)

Conagra Brands (CPB)

Conagra Brands (AMNF)

Conagra Brands (GMFIY)

Conagra Brands (BRID)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FOOD-MISC/DIVERSIFIED

Sector: Consumer Staples

CUSIP: 205887102

SIC: 2000

|

|

Fiscal Year

Fiscal Year End: May

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 04/02/26

|

|

Share - Related Items

Shares Outstanding: 478.37

Most Recent Split Date: 10.00 (2.00:1)

Beta: -0.02

Market Capitalization: $9,208.61 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 7.27% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.40 |

Indicated Annual Dividend: $1.40 |

| Current Fiscal Year EPS Consensus Estimate: $1.73 |

Payout Ratio: 0.73 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.20 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/27/2026 - $0.35 |

| Next EPS Report Date: 04/02/26 |

|

|

|

| |