| Zacks Company Profile for Casey's General Stores, Inc. (CASY : NSDQ) |

|

|

| |

| • Company Description |

| Casey's General Stores, Inc. operates convenience stores under the Casey's and Casey's General Store names in Midwestern states, mainly Iowa, Missouri and Illinois. The company also operates two stores under the name `Tobacco City`, selling primarily tobacco and nicotine products, one liquor store, and one grocery store. The company's stores offer a variety of food selection (including freshly prepared foods such as pizza, donuts and sandwiches), beverages, tobacco and nicotine products, health and beauty aids, school supplies, housewares, pet supplies, and automotive products. Each Casey's Store carries food and nonfood items. Many of the products offered are those generally found in a supermarket. The selection is generally limited to one or two well-known brands of each item stocked.

Number of Employees: 49,272 |

|

|

| |

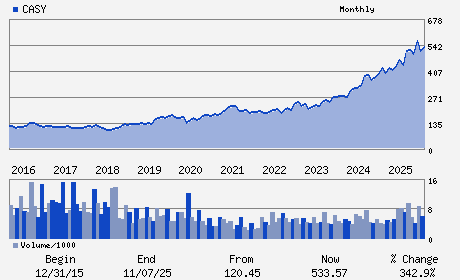

| • Price / Volume Information |

| Yesterday's Closing Price: $685.59 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 315,896 shares |

| Shares Outstanding: 37.07 (millions) |

| Market Capitalization: $25,412.77 (millions) |

| Beta: 0.68 |

| 52 Week High: $690.00 |

| 52 Week Low: $372.09 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

12.15% |

13.62% |

| 12 Week |

21.74% |

21.36% |

| Year To Date |

24.04% |

22.32% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Darren M. Rebelez - President; Chief Executive Officer and Board Cha

Stephen P. Bramlage Jr. - Chief Financial Officer

Cara K. Heiden - Director

Donald E. Frieson - Director

Larree M. Renda - Director

|

|

Peer Information

Casey's General Stores, Inc. (DMCSQ)

Casey's General Stores, Inc. (XXFPL)

Casey's General Stores, Inc. (SE.2)

Casey's General Stores, Inc. (SVELY)

Casey's General Stores, Inc. (PTRY)

Casey's General Stores, Inc. (DMC.B)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-CNV STRS

Sector: Retail/Wholesale

CUSIP: 147528103

SIC: 5500

|

|

Fiscal Year

Fiscal Year End: April

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/09/26

|

|

Share - Related Items

Shares Outstanding: 37.07

Most Recent Split Date: 2.00 (2.00:1)

Beta: 0.68

Market Capitalization: $25,412.77 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.33% |

| Current Fiscal Quarter EPS Consensus Estimate: $3.16 |

Indicated Annual Dividend: $2.28 |

| Current Fiscal Year EPS Consensus Estimate: $17.39 |

Payout Ratio: 0.14 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 16.28% |

Last Dividend Paid: 01/30/2026 - $0.57 |

| Next EPS Report Date: 03/09/26 |

|

|

|

| |