| Zacks Company Profile for CBRE Group, Inc. (CBRE : NYSE) |

|

|

| |

| • Company Description |

| CBRE Group, Inc. is a commercial real estate services and investment firm, offering a wide range of services to tenants, owners, lenders and investors in office, retail, industrial, multi-family and other types of commercial real estates in all major metropolitan areas across the globe. The services include facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. CBRE Group reports on three global business segments: Advisory Services, Global Workplace Solutions and Real Estate Investments. Advisory Services offers services in property leasing, sales, mortgage services, management and valuation. Global Workplace Solutions offers integrated, contractually-based outsourcing services to occupiers of real estate. Real Estate Investments includes investment management services provided globally, development services and flexible office space solutions.

Number of Employees: 155,000 |

|

|

| |

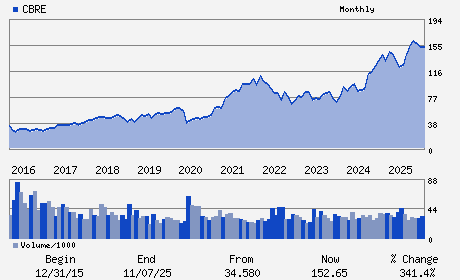

| • Price / Volume Information |

| Yesterday's Closing Price: $147.66 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,208,151 shares |

| Shares Outstanding: 295.16 (millions) |

| Market Capitalization: $43,583.12 (millions) |

| Beta: 1.33 |

| 52 Week High: $174.27 |

| 52 Week Low: $108.45 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-13.31% |

-12.55% |

| 12 Week |

-8.21% |

-8.32% |

| Year To Date |

-8.17% |

-8.61% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2121 NORTH PEARL STREET SUITE 300

-

DALLAS,TX 75201

USA |

ph: 214-979-6100

fax: 213-613-3005 |

chandni.luthra@cbre.com |

http://www.cbre.com |

|

|

| |

| • General Corporate Information |

Officers

Robert E. Sulentic - Chief Executive Officer; Chair of the Board and Pr

Emma E. Giamartino - Chief Financial Officer

Andrew S. Horn - Chief Accounting Officer

Brandon B. Boze - Director

Vincent Clancy - Director

|

|

Peer Information

CBRE Group, Inc. (ARL)

CBRE Group, Inc. (FNDOY)

CBRE Group, Inc. (AOXY)

CBRE Group, Inc. (HLDCY)

CBRE Group, Inc. (IOR)

CBRE Group, Inc. (GYRO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REAL ESTATE OPS

Sector: Finance

CUSIP: 12504L109

SIC: 6500

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 295.16

Most Recent Split Date: 6.00 (3.00:1)

Beta: 1.33

Market Capitalization: $43,583.12 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.09 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $7.43 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |