| Zacks Company Profile for City Developments Ltd. (CDEVY : OTC) |

|

|

| |

| • Company Description |

| City Developments Limited (CDL) is one of the largest real estate companies of Singapore. By market capitalization, the firm's income-stable and geographically-diversified portfolio comprises residences, offices, hotels, serviced apartments, integrated developments and shopping malls. CDL has hotel assets in one of the world's largest hotel groups - its London-listed subsidiary, Millennium & Copthorne Hotels plc (M&C), has over 130 hotels globally, many in key gateway cities. Globally, CDL has developed over 40,000 homes and is one of Singapore's largest commercial landlords, with one of the biggest land banks amongst Singapore private-sector developers. Building on its track record of over 50 years in real estate development, investment and management, CDL has developed growth platforms in five key international markets - UK, US, China, Japan and Australia. The Company is also leveraging its stable of prime assets and growing its real estate funds management business.

Number of Employees: |

|

|

| |

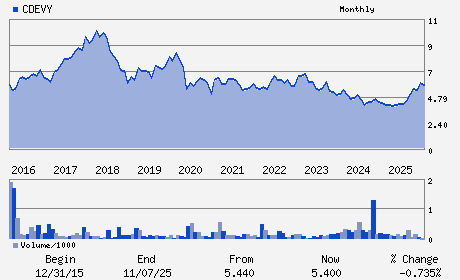

| • Price / Volume Information |

| Yesterday's Closing Price: $7.30 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 19,811 shares |

| Shares Outstanding: 893.40 (millions) |

| Market Capitalization: $6,521.83 (millions) |

| Beta: 0.23 |

| 52 Week High: $8.20 |

| 52 Week Low: $3.24 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.96% |

3.86% |

| 12 Week |

29.32% |

28.35% |

| Year To Date |

22.07% |

20.95% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

9 RAFFLES PLACE NO 12-01 REPUBLIC PLAZA

-

SINGAPORE,U0 048619

SGP |

ph: 65-6877-8228

fax: 65-6223-2746 |

belindalee@cdl.com |

http://www.cdl.com.sg |

|

|

| |

| • General Corporate Information |

Officers

Sherman Kwek - Chief Executive Officer

Kwek Leng Beng - Executive Chairman

Kwek Eik Sheng - Chief Operating Officer

Yim Ming Yiong - Chief Financial Officer

Lee Jee Cheng Philip - Director

|

|

Peer Information

City Developments Ltd. (ARL)

City Developments Ltd. (FNDOY)

City Developments Ltd. (AOXY)

City Developments Ltd. (HLDCY)

City Developments Ltd. (IOR)

City Developments Ltd. (GYRO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REAL ESTATE OPS

Sector: Finance

CUSIP: 177797305

SIC: 6552

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: 02/27/26

|

|

Share - Related Items

Shares Outstanding: 893.40

Most Recent Split Date: 6.00 (1.20:1)

Beta: 0.23

Market Capitalization: $6,521.83 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.25% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.02 |

| Current Fiscal Year EPS Consensus Estimate: $0.17 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/27/26 |

|

|

|

| |