| Zacks Company Profile for CareDx, Inc. (CDNA : NSDQ) |

|

|

| |

| • Company Description |

| CareDx, Inc. is a commercial stage company. It develops, markets, and delivers a diagnostic surveillance solution for heart transplant recipients. The Company provides AlloMap, a noninvasive blood test used to aid in the identification of heart transplant recipients. It is also pursuing other areas of transplant surveillance, such as the use of cell-free DNA (cfDNA) as a biomarker for rejection. CareDx, Inc. is based in Brisbane, California.

Number of Employees: 765 |

|

|

| |

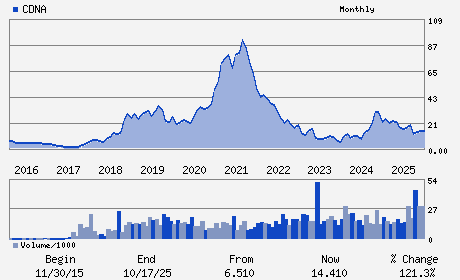

| • Price / Volume Information |

| Yesterday's Closing Price: $18.76 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 668,986 shares |

| Shares Outstanding: 51.22 (millions) |

| Market Capitalization: $960.82 (millions) |

| Beta: 2.52 |

| 52 Week High: $22.61 |

| 52 Week Low: $10.96 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-8.71% |

-7.91% |

| 12 Week |

1.24% |

1.12% |

| Year To Date |

-0.42% |

-0.91% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

8000 Marina Boulevard 4th Floor

-

Brisbane,CA 94005

USA |

ph: 415-287-2300

fax: 415-287-2450 |

investor@caredx.com |

http://www.caredx.com |

|

|

| |

| • General Corporate Information |

Officers

John W. Hanna - President and Chief Executive Officer

Nathan Smith - Chief Financial Officer

Fred E. Cohen - Director

Christine M. Cournoyer - Director

Michael D. Goldberg - Director

|

|

Peer Information

CareDx, Inc. (CHCR)

CareDx, Inc. (ESRX)

CareDx, Inc. (MYDP)

CareDx, Inc. (COR)

CareDx, Inc. (GBCS)

CareDx, Inc. (LAXAF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Medical Services

Sector: Medical

CUSIP: 14167L103

SIC: 8071

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 51.22

Most Recent Split Date: (:1)

Beta: 2.52

Market Capitalization: $960.82 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.06 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.09 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |