| Zacks Company Profile for Central Garden & Pet Company (CENTA : NSDQ) |

|

|

| |

| • Company Description |

| Central Garden & Pet Company is a leading innovator, marketer and producer of quality branded products for the lawn & garden and pet supplies markets. Committed to new product innovation, their products are sold to specialty independent and mass retailers. Participating categories in Lawn & Garden include: Grass seed and the brands PENNINGTON, and THE REBELS; wild bird feed and the brand PENNINGTON; weed and insect control and the brands AMDRO, SEVIN, IRONITE and OVER-N-OUT; and decorative outdoor patio products under the PENNINGTON brand. Participating categories in Pet include: Animal health and the brands ADAMS and ZODIAC; aquatics and reptile and the brands AQUEON, CORALIFE, SEGREST and ZILLA; bird & small animal and the brands KAYTEE, Forti-Diet and CRITTER TRAIL; dog & cat and the brands TFH, NYLABONE, FOUR PAWS, IMS, CADET, DMC, K&H Pet Products, PINNACLE and AVODERM; and equine and the brands FARNAM, HORSE HEALTH and VITAFLEX.

Number of Employees: |

|

|

| |

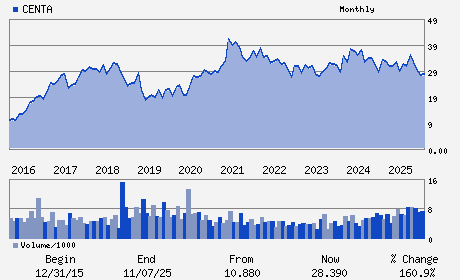

| • Price / Volume Information |

| Yesterday's Closing Price: $34.54 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 277,445 shares |

| Shares Outstanding: 62.27 (millions) |

| Market Capitalization: $2,150.72 (millions) |

| Beta: 0.63 |

| 52 Week High: $37.35 |

| 52 Week Low: $25.93 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

12.62% |

13.60% |

| 12 Week |

13.47% |

13.33% |

| Year To Date |

18.33% |

17.75% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1340 TREAT BOULEVARD SUITE 600

-

WALNUT CREEK,CA 94597

- |

ph: 925-948-4000

fax: - |

None |

http://www.central.com |

|

|

| |

| • General Corporate Information |

Officers

Nicholas Lahanas - Chief Executive Officer

William E. Brown - Chairman

Bradley G. Smith - Chief Financial Officer

Howard A. Machek - Senior Vice President and Chief Accounting Offic

Mary Beth Springer - Director

|

|

Peer Information

Central Garden & Pet Company (LENXQ)

Central Garden & Pet Company (BFXXQ)

Central Garden & Pet Company (CENT)

Central Garden & Pet Company (FTDL)

Central Garden & Pet Company (BTH)

Central Garden & Pet Company (JAH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CONSM PD-MISC DIS

Sector: Consumer Discretionary

CUSIP: 153527205

SIC: 5190

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 62.27

Most Recent Split Date: 2.00 (1.25:1)

Beta: 0.63

Market Capitalization: $2,150.72 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.07 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.83 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |