| Zacks Company Profile for Comstock Holding Companies, Inc. (CHCI : NSDQ) |

|

|

| |

| • Company Description |

| Comstock Homebuilding Companies is a production homebuilder that develops, builds, and markets single-family homes, townhouses, and condominiums. The Company currently operates in the Washington, D.C. and Raleigh, North Carolina markets where it targets a diverse range of buyers, including first-time, early move-up, secondary move-up, empty nester move-down and active adult home buyers.

Number of Employees: 251 |

|

|

| |

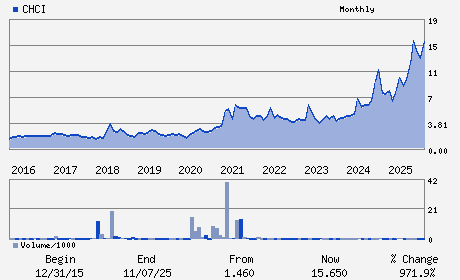

| • Price / Volume Information |

| Yesterday's Closing Price: $11.67 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 9,172 shares |

| Shares Outstanding: 10.09 (millions) |

| Market Capitalization: $117.72 (millions) |

| Beta: -0.09 |

| 52 Week High: $18.99 |

| 52 Week Low: $6.31 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.99% |

6.92% |

| 12 Week |

-13.75% |

-13.85% |

| Year To Date |

0.43% |

-0.06% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Christopher Clemente - Chief Executive Officer and Chairman of the Board

Christopher Guthrie - Chief Financial Officer

David M. Guernsey - Director

Thomas J. Holly - Director

David P. Paul - Director

|

|

Peer Information

Comstock Holding Companies, Inc. (CLPO)

Comstock Holding Companies, Inc. (IAHM)

Comstock Holding Companies, Inc. (HLCO)

Comstock Holding Companies, Inc. (ENGEF)

Comstock Holding Companies, Inc. (BZH)

Comstock Holding Companies, Inc. (CSHHY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG-RSDNT/COMR

Sector: Construction

CUSIP: 205684202

SIC: 6500

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/20/26

|

|

Share - Related Items

Shares Outstanding: 10.09

Most Recent Split Date: 9.00 (0.14:1)

Beta: -0.09

Market Capitalization: $117.72 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/20/26 |

|

|

|

| |