| Zacks Company Profile for CKX Lands, Inc. (CKX : AMEX) |

|

|

| |

| • Company Description |

| CKX Lands, Inc. owns land and mineral interests and collects income through its ownership in the form of oil and gas royalties, surface leases for farming, right of way and other uses as well as timber sales. CKX Lands Inc., formerly known as Calcasieu Real Estate & Oil Co. Inc., is based in Lake Charles, United States.

Number of Employees: 2 |

|

|

| |

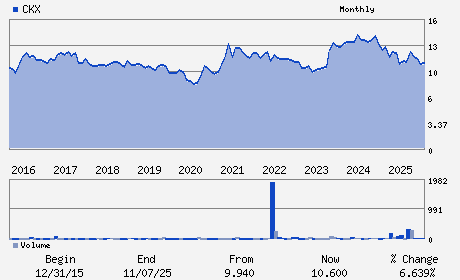

| • Price / Volume Information |

| Yesterday's Closing Price: $10.90 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,008 shares |

| Shares Outstanding: 2.05 (millions) |

| Market Capitalization: $22.38 (millions) |

| Beta: -0.19 |

| 52 Week High: $13.25 |

| 52 Week Low: $8.66 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.85% |

-1.58% |

| 12 Week |

12.72% |

12.36% |

| Year To Date |

19.13% |

19.12% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2417 SHELL BEACH DRIVE

-

LAKE CHARLES,LA 70601

USA |

ph: 337-493-2399

fax: - |

None |

http://www.ckxlands.com |

|

|

| |

| • General Corporate Information |

Officers

W. Gray Stream - President and Chairman of the Board of Directors

Scott A. Stepp - Chief Financial Officer

Lee W. Boyer - Secretary and Director

Keith Duplechin - Director

Daniel J. Englander - Director

|

|

Peer Information

CKX Lands, Inc. (ARL)

CKX Lands, Inc. (FNDOY)

CKX Lands, Inc. (AOXY)

CKX Lands, Inc. (HLDCY)

CKX Lands, Inc. (IOR)

CKX Lands, Inc. (GYRO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REAL ESTATE OPS

Sector: Finance

CUSIP: 12562N104

SIC: 1311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/24/26

|

|

Share - Related Items

Shares Outstanding: 2.05

Most Recent Split Date: (:1)

Beta: -0.19

Market Capitalization: $22.38 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/24/26 |

|

|

|

| |