| Zacks Company Profile for Clearfield, Inc. (CLFD : NSDQ) |

|

|

| |

| • Company Description |

| CLEARFIELD INC., formerly APA Cables & Networks, designs and manufactures the FieldSmart fiber management platform, which includes its latest generation Fiber Distribution System and Fiber Scalability Center. The FDS and FSC product-lines support a wide range of panel configurations, densities, connectors and adapter options and is offered alongside an assortment of passive optical components. Clearfield also provides a complete line of fiber and copper assemblies for controlled and outside plant environments.

Number of Employees: 243 |

|

|

| |

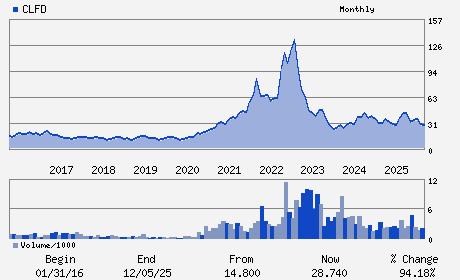

| • Price / Volume Information |

| Yesterday's Closing Price: $32.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 116,188 shares |

| Shares Outstanding: 13.69 (millions) |

| Market Capitalization: $440.67 (millions) |

| Beta: 1.94 |

| 52 Week High: $46.76 |

| 52 Week Low: $23.78 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.44% |

8.38% |

| 12 Week |

11.53% |

10.70% |

| Year To Date |

10.46% |

9.45% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Cheryl Beranek - President; Chief Executive Officer

Daniel Herzog - Chief Financial Officer

Ronald G. Roth - Director

Catherine T. Kelly - Director

Donald R. Hayward - Director

|

|

Peer Information

Clearfield, Inc. (CMTL)

Clearfield, Inc. (UMAC)

Clearfield, Inc. (ANEN)

Clearfield, Inc. (ERIC)

Clearfield, Inc. (CLUS)

Clearfield, Inc. (BKTI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Wireless Equipment

Sector: Computer and Technology

CUSIP: 18482P103

SIC: 3661

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 13.69

Most Recent Split Date: 4.00 (2.00:1)

Beta: 1.94

Market Capitalization: $440.67 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.04 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.67 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |