| Zacks Company Profile for Calumet, Inc. (CLMT : NSDQ) |

|

|

| |

| • Company Description |

| Calumet Inc. manufactures, formulates and markets a diversified slate of specialty branded products and renewable fuels to customers across a broad range of consumer-facing and industrial markets. Calumet Inc., formerly known as Calumet Specialty Products Partners L.P., is based in INDIANAPOLIS.

Number of Employees: 1,620 |

|

|

| |

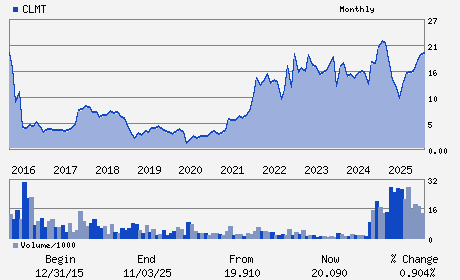

| • Price / Volume Information |

| Yesterday's Closing Price: $26.96 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,458,213 shares |

| Shares Outstanding: 86.75 (millions) |

| Market Capitalization: $2,338.90 (millions) |

| Beta: 1.18 |

| 52 Week High: $30.35 |

| 52 Week Low: $7.68 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

20.30% |

21.35% |

| 12 Week |

39.40% |

39.23% |

| Year To Date |

35.68% |

35.02% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1060 N Capitol Ave Suite 6-401

-

INDIANAPOLIS,IN 46204

USA |

ph: 317-328-5660

fax: 317-328-2359 |

clmt@alpha-ir.com |

https://calumet.com |

|

|

| |

| • General Corporate Information |

Officers

Todd Borgmann - President and Chief Executive Officer

Stephen P. Mawer - Chairman

David Lunin - Executive Vice President and Chief Financial Offic

James S. Carter - Director

Karen A. Twitchell - Director

|

|

Peer Information

Calumet, Inc. (HES)

Calumet, Inc. (CWPE)

Calumet, Inc. (EPCC.)

Calumet, Inc. (PHX)

Calumet, Inc. (NFG)

Calumet, Inc. (KMG.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL-US INTEGRTD

Sector: Oils/Energy

CUSIP: 131428104

SIC: 2911

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/08/26

|

|

Share - Related Items

Shares Outstanding: 86.75

Most Recent Split Date: (:1)

Beta: 1.18

Market Capitalization: $2,338.90 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.92 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.32 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 39.11% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/08/26 |

|

|

|

| |