| Zacks Company Profile for Core & Main, Inc. (CNM : NYSE) |

|

|

| |

| • Company Description |

| Core & Main Inc. is a specialized distributor of water, wastewater, storm drainage and fire protection products, and related services, to municipalities, private water companies and professional contractors across municipal, non-residential and residential end markets. The company's products and services are used in the maintenance, repair, replacement and construction of water and fire protection infrastructure. Core & Main Inc. is based in St. Louis.

Number of Employees: 5,700 |

|

|

| |

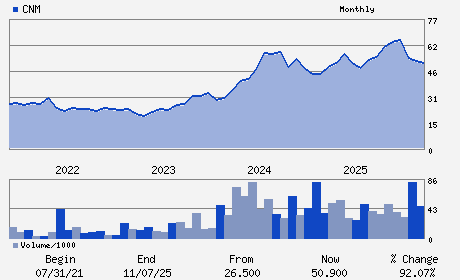

| • Price / Volume Information |

| Yesterday's Closing Price: $53.41 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,355,154 shares |

| Shares Outstanding: 195.51 (millions) |

| Market Capitalization: $10,442.31 (millions) |

| Beta: 0.98 |

| 52 Week High: $67.18 |

| 52 Week Low: $43.18 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.33% |

6.52% |

| 12 Week |

8.45% |

3.61% |

| Year To Date |

2.77% |

2.58% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Mark R. Witkowski - Chief Executive Officer and Director

Stephen O. LeClair - Executive Chairman

Bradford A. Cowles - President

Robyn L. Bradbury - Chief Financial Officer

Dennis G. Gipson - Director

|

|

Peer Information

Core & Main, Inc. (DVLGQ)

Core & Main, Inc. (CNM)

Core & Main, Inc. (FLOW.)

Core & Main, Inc. (AMDLY)

Core & Main, Inc. (HURC)

Core & Main, Inc. (LECO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH TLS&RL PRD

Sector: Industrial Products

CUSIP: 21874C102

SIC: 5099

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/24/26

|

|

Share - Related Items

Shares Outstanding: 195.51

Most Recent Split Date: (:1)

Beta: 0.98

Market Capitalization: $10,442.31 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.46 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.86 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 10.41% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/24/26 |

|

|

|

| |