| Zacks Company Profile for Cohu, Inc. (COHU : NSDQ) |

|

|

| |

| • Company Description |

| Cohu is a leading supplier of semiconductor test and inspection handlers, micro-electro mechanical system (MEMS) test modules, test contactors and thermal sub-systems used by global semiconductor manufacturers and test subcontractors.

Number of Employees: 2,857 |

|

|

| |

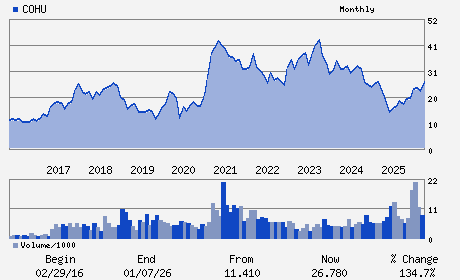

| • Price / Volume Information |

| Yesterday's Closing Price: $30.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,018,347 shares |

| Shares Outstanding: 46.89 (millions) |

| Market Capitalization: $1,416.03 (millions) |

| Beta: 1.27 |

| 52 Week High: $34.96 |

| 52 Week Low: $12.57 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.82% |

6.74% |

| 12 Week |

20.90% |

20.75% |

| Year To Date |

29.78% |

29.15% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

12367 CROSTHWAITE CIRCLE

-

POWAY,CA 92064

USA |

ph: 858-848-8100

fax: 858-848-8185 |

corp@cohu.com |

http://www.cohu.com |

|

|

| |

| • General Corporate Information |

Officers

Luis A. Muller - President and Chief Executive Officer; Director

James A. Donahue - Chairperson of the Board

Jeffrey D. Jones - Senior Vice President; Finance and CFO

William E. Bendush - Director

Steven J. Bilodeau - Director

|

|

Peer Information

Cohu, Inc. (BESIY)

Cohu, Inc. (NEXT2)

Cohu, Inc. (EGLSQ)

Cohu, Inc. (BTUI)

Cohu, Inc. (DAWKQ)

Cohu, Inc. (EMKR)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC-MANUFT MACH

Sector: Computer and Technology

CUSIP: 192576106

SIC: 3825

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 46.89

Most Recent Split Date: 9.00 (2.00:1)

Beta: 1.27

Market Capitalization: $1,416.03 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.08 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.12 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |