| Zacks Company Profile for Custom Truck One Source, Inc. (CTOS : NYSE) |

|

|

| |

| • Company Description |

| Custom Truck One Source Inc. is a provider of specialized truck and heavy equipment solutions to the utility, telecommunications, rail and infrastructure markets principally in North America. The Company's solutions include rentals, sales, aftermarket parts, tools, accessories and service, equipment production, manufacturing, financing solutions and asset disposal. Custom Truck One Source Inc., formerly known as Nesco Holdings Inc., is based in KANSAS CITY, Mo.

Number of Employees: 261 |

|

|

| |

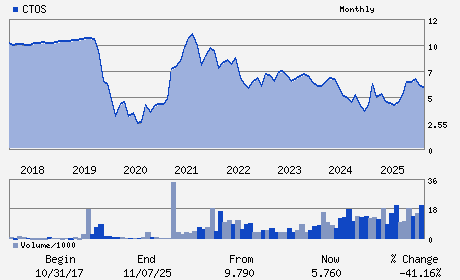

| • Price / Volume Information |

| Yesterday's Closing Price: $7.16 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 913,353 shares |

| Shares Outstanding: 226.56 (millions) |

| Market Capitalization: $1,622.17 (millions) |

| Beta: 1.17 |

| 52 Week High: $7.75 |

| 52 Week Low: $3.18 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

13.29% |

14.78% |

| 12 Week |

17.38% |

17.01% |

| Year To Date |

24.31% |

25.40% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ryan McMonagle - Chief Executive Officer and Director

Marshall Heinberg - Chairman

Christopher J. Eperjesy - Chief Financial Officer

R. Todd Barrett - Chief Accounting Officer

Paul Bader - Director

|

|

Peer Information

Custom Truck One Source, Inc. (M.BUD)

Custom Truck One Source, Inc. (DCNAQ)

Custom Truck One Source, Inc. (CGUL)

Custom Truck One Source, Inc. (DAN)

Custom Truck One Source, Inc. (CTTAY)

Custom Truck One Source, Inc. (M.DEC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AUTO/TRUCK-ORIG

Sector: Auto/Tires/Trucks

CUSIP: 23204X103

SIC: 7359

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/10/26

|

|

Share - Related Items

Shares Outstanding: 226.56

Most Recent Split Date: (:1)

Beta: 1.17

Market Capitalization: $1,622.17 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.06 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.04 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/10/26 |

|

|

|

| |