| Zacks Company Profile for Curtiss-Wright Corporation (CW : NYSE) |

|

|

| |

| • Company Description |

| Curtiss-Wright Corp. is a diversified multinational company that designs and overhauls precision components. It provides highly engineered products and services for high-performance platforms, and critical applications in key areas such as commercial aerospace and defense electronics, reactor coolant pumps for next-generation nuclear reactors as well as advanced surface treatment technologies. Its products & services are offered to the aerospace, defense, general industrial and power generation markets. It has 3 business segments: Aerospace & Industrial, Defense Electronics, and Naval & Power. Aerospace & Industrial: In this unit, sales are generated from the commercial aerospace and general industrial markets, and to a lesser extent the defense and power & process markets. Defense Electronics: Here sales are generated from the defense markets and, to a lesser extent, the commercial aerospace market. Naval & Power: Sales in this business unit are generated from the power & process and naval defense markets.

Number of Employees: 9,100 |

|

|

| |

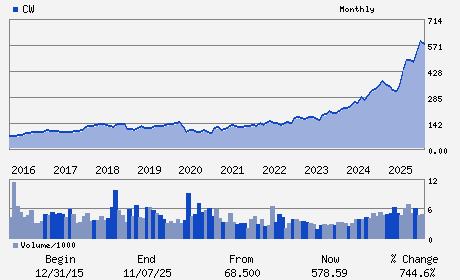

| • Price / Volume Information |

| Yesterday's Closing Price: $700.33 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 354,107 shares |

| Shares Outstanding: 36.87 (millions) |

| Market Capitalization: $25,820.84 (millions) |

| Beta: 0.91 |

| 52 Week High: $719.05 |

| 52 Week Low: $266.88 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.65% |

7.58% |

| 12 Week |

28.59% |

28.44% |

| Year To Date |

27.04% |

26.42% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Lynn M. Bamford - Chair and Chief Executive Officer

K. Christopher Farkas - Executive Vice President and Chief Financial Offic

Robert F. Freda - Senior Vice President and Treasurer

Dean M. Flatt - Directors

Bruce D. Hoechner - Directors

|

|

Peer Information

Curtiss-Wright Corporation (T.CAE)

Curtiss-Wright Corporation (ADGI.)

Curtiss-Wright Corporation (CVU)

Curtiss-Wright Corporation (CW)

Curtiss-Wright Corporation (DCO)

Curtiss-Wright Corporation (DRS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AEROSP/DEF EQ

Sector: Aerospace

CUSIP: 231561101

SIC: 3590

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 36.87

Most Recent Split Date: 4.00 (2.00:1)

Beta: 0.91

Market Capitalization: $25,820.84 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.14% |

| Current Fiscal Quarter EPS Consensus Estimate: $3.24 |

Indicated Annual Dividend: $0.96 |

| Current Fiscal Year EPS Consensus Estimate: $15.02 |

Payout Ratio: 0.07 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: 13.66% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |