| Zacks Company Profile for Dropbox, Inc. (DBX : NSDQ) |

|

|

| |

| • Company Description |

| Dropbox, Inc. is a service company. It offers a platform which enables users to store and share files, photos, videos, songs and spreadsheets. Dropbox, Inc. is headquartered in San Francisco, California.

Number of Employees: 2,113 |

|

|

| |

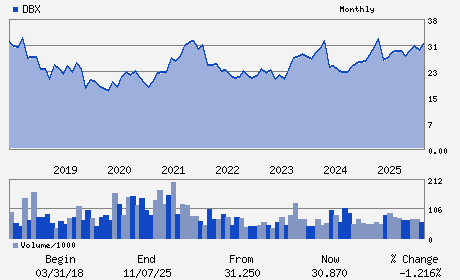

| • Price / Volume Information |

| Yesterday's Closing Price: $24.99 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 5,062,391 shares |

| Shares Outstanding: 241.19 (millions) |

| Market Capitalization: $6,027.30 (millions) |

| Beta: 0.63 |

| 52 Week High: $32.40 |

| 52 Week Low: $23.63 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.92% |

-1.07% |

| 12 Week |

-14.83% |

-14.93% |

| Year To Date |

-10.11% |

-10.54% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1800 OWENS STREET

-

SAN FRANCISCO,CA 94158

USA |

ph: 415-930-7766

fax: - |

ir@dropbox.com |

http://www.dropbox.com |

|

|

| |

| • General Corporate Information |

Officers

Andrew W. Houston - Chief Executive Officer and Chairman

Ross Tennenbaum - Chief Financial Officer

Andrew Moore - Director

Abhay Parasnis - Director

Karen A. Peacock - Director

|

|

Peer Information

Dropbox, Inc. (BIZZ)

Dropbox, Inc. (DCLK)

Dropbox, Inc. (DGIN.)

Dropbox, Inc. (DVW)

Dropbox, Inc. (CYCHZ)

Dropbox, Inc. (IFXC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SERVICES

Sector: Computer and Technology

CUSIP: 26210C104

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 241.19

Most Recent Split Date: (:1)

Beta: 0.63

Market Capitalization: $6,027.30 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.46 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.03 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 7.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |