| Zacks Company Profile for Doximity, Inc. (DOCS : NYSE) |

|

|

| |

| • Company Description |

| Doximity Inc. provides digital platform for medical professionals. The company's network members include physicians across all specialties and practice areas. It provide its verified clinical membership with digital tools built for medicine, enabling them to collaborate with colleagues, stay up to date with the latest medical news and research, manage their careers and conduct virtual patient visits. Doximity Inc. is based in SAN FRANCISCO.

Number of Employees: 830 |

|

|

| |

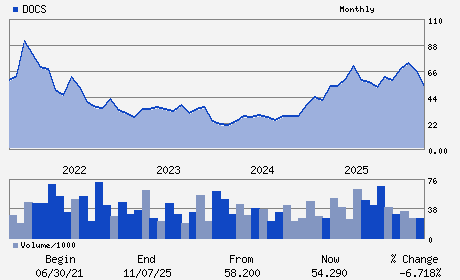

| • Price / Volume Information |

| Yesterday's Closing Price: $25.10 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 5,140,637 shares |

| Shares Outstanding: 184.71 (millions) |

| Market Capitalization: $4,636.19 (millions) |

| Beta: 1.39 |

| 52 Week High: $76.51 |

| 52 Week Low: $23.53 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-35.03% |

-34.46% |

| 12 Week |

-51.08% |

-51.45% |

| Year To Date |

-43.31% |

-43.83% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

500 THIRD STREET SUITE 510

-

SAN FRANCISCO,CA 94107

USA |

ph: 650-549-4330

fax: - |

ir@doximity.com |

http://www.doximity.com |

|

|

| |

| • General Corporate Information |

Officers

Jeffrey Tangney - Chief Executive Officer and Director

Anna Bryson - Chief Financial Officer

Regina Benjamin - Director

Tim Cabral - Director

Phoebe Yang - Director

|

|

Peer Information

Doximity, Inc. (HLIS)

Doximity, Inc. (AZTA)

Doximity, Inc. (APYI)

Doximity, Inc. (RNVA)

Doximity, Inc. (HMSY)

Doximity, Inc. (LRSI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MEDICAL INFO SYS

Sector: Medical

CUSIP: 26622P107

SIC: 7371

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/21/26

|

|

Share - Related Items

Shares Outstanding: 184.71

Most Recent Split Date: (:1)

Beta: 1.39

Market Capitalization: $4,636.19 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.17 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.11 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 16.06% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/21/26 |

|

|

|

| |