| Zacks Company Profile for Daiwa Securities Group Inc. (DSEEY : OTC) |

|

|

| |

| • Company Description |

| Daiwa Securities Group Inc. is engaged in providing comprehensive financial services by operating in businesses such as retail and wholesale securities, investment, asset management, as well as system support and research services. Daiwa offers consulting and online trading and handling a complete spectrum of financial products and services through its retail business and provides brokerage, investment banking and M&A advisory services through its wholesale business. Its investment business focuses largely on venture capital investments, organizing and managing of private equity funds and conducting direct investments in monetary claims. The Company's asset management business is involved in creating and managing investment trusts, offering pension fund management and management of REIT (Real Estate Investment Trust). It also offers system-consulting and system-integration service for outside-Group clients. Daiwa Securities Group Inc. is headquartered in Tokyo, Japan.

Number of Employees: |

|

|

| |

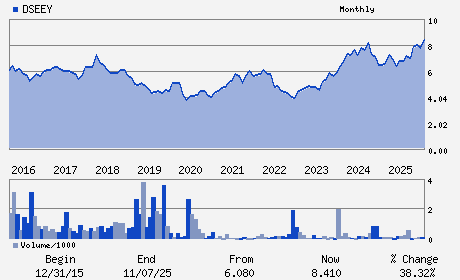

| • Price / Volume Information |

| Yesterday's Closing Price: $10.51 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,930 shares |

| Shares Outstanding: 1,414.98 (millions) |

| Market Capitalization: $14,873.52 (millions) |

| Beta: 0.50 |

| 52 Week High: $11.24 |

| 52 Week Low: $5.52 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.81% |

8.75% |

| 12 Week |

23.59% |

23.44% |

| Year To Date |

19.65% |

19.07% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

GRAN TOKYO NORTH TOWER 9-1 MARUNOUCHI 1-CHOME CHIYODA-KU

-

TOKYO,M0 100-6751

JPN |

ph: 813-5555-1111

fax: 813-3242-0955 |

ir-section@daiwa.co.jp |

http://www.daiwa-grp.jp |

|

|

| |

| • General Corporate Information |

Officers

Akihiko Ogino - President and Chief Executive Officer

Seiji Nakata - Chairman

Shinsuke Niizuma - Deputy President; Chief Operating Officer & Corpor

Keiko Tashiro - Corporate Executive Officer

Sachiko Hanaoka - Director

|

|

Peer Information

Daiwa Securities Group Inc. (EIIN)

Daiwa Securities Group Inc. (AFMI)

Daiwa Securities Group Inc. (DRL)

Daiwa Securities Group Inc. (GRFPY)

Daiwa Securities Group Inc. (IGOT)

Daiwa Securities Group Inc. (ATLC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-MISC SVCS

Sector: Finance

CUSIP: 234064301

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/27/26

|

|

Share - Related Items

Shares Outstanding: 1,414.98

Most Recent Split Date: (:1)

Beta: 0.50

Market Capitalization: $14,873.52 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.45% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.26 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.40 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: -0.03 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/27/26 |

|

|

|

| |