| Zacks Company Profile for Dycom Industries, Inc. (DY : NYSE) |

|

|

| |

| • Company Description |

| Dycom Industries, Inc. is a leading provider of specialty contracting services throughout the U.S. It supplies telecommunications providers with a comprehensive portfolio of specialty services, including program management, planning, engineering and design, aerial, underground, and wireless construction, maintenance, and fulfillment services for telecommunications providers and underground facility locating services for various utilities, including telecommunications providers, and other construction and maintenance services for electric and gas utilities and also supplies the labor, tools, and equipment. It provides engineering services to telecommunications providers, including the planning and design of aerial, underground, and buried fiber optic, copper, and coaxial cable systems that extend from the telephone company hub location, or cable operator headend, to the consumer?s home or business. It excavates trenches in which to place these cables, place related structures.

Number of Employees: 15,623 |

|

|

| |

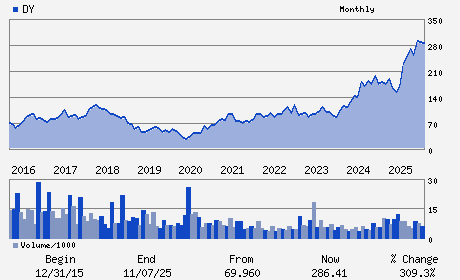

| • Price / Volume Information |

| Yesterday's Closing Price: $420.02 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 392,942 shares |

| Shares Outstanding: 28.96 (millions) |

| Market Capitalization: $12,162.12 (millions) |

| Beta: 1.34 |

| 52 Week High: $445.53 |

| 52 Week Low: $131.37 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

15.27% |

16.27% |

| 12 Week |

19.39% |

19.25% |

| Year To Date |

24.30% |

23.70% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Daniel S. Peyovich - Chief Executive Officer;President and Director

Kevin M. Wetherington - Executive Vice President and Chief Operating Offic

H. Andrew DeFerrari - Senior Vice President and Chief Financial Officer

Heather M. Floyd - Vice President and Chief Accounting Officer

Luis Avila-Marco - Director

|

|

Peer Information

Dycom Industries, Inc. (DBCOQ)

Dycom Industries, Inc. (PHOE)

Dycom Industries, Inc. (UNTKQ)

Dycom Industries, Inc. (MTZ)

Dycom Industries, Inc. (CBI)

Dycom Industries, Inc. (GMDBY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG-HEAVY CNST

Sector: Construction

CUSIP: 267475101

SIC: 1623

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/04/26

|

|

Share - Related Items

Shares Outstanding: 28.96

Most Recent Split Date: 2.00 (1.50:1)

Beta: 1.34

Market Capitalization: $12,162.12 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.50 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $12.56 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 24.24% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/04/26 |

|

|

|

| |