| Zacks Company Profile for Brinker International, Inc. (EAT : NYSE) |

|

|

| |

| • Company Description |

| Brinker International primarily owns, operates, develops and franchises various restaurants under Chili's Grill & Bar (Chili's) and Maggiano's Little Italy (Maggiano's) brands. The company took over Chili's, Inc., a Texas corporation and Maggiano's. With a global presence across countries and territories outside the U.S., the brand features typical American menu. Additionally, it is known for gourmet burgers, sizzling fajitas, baby back ribs and hand-shaken margaritas. Brinker relaunched it's My Chili's Rewards program and began offering free chips and salsa or soft drink to members at every visit. Maggiano's is a full-service, national, casual dining Italian restaurant brand, featuring individual and family-style menus, and most restaurants. The brand also has extensive banquet facilities designed to host large party business or social events. The menu features a classic Italian-American range in forms of appetizers and entrees, with portions of pasta, chicken, seafood, veal, prime steaks and desserts.

Number of Employees: 83,840 |

|

|

| |

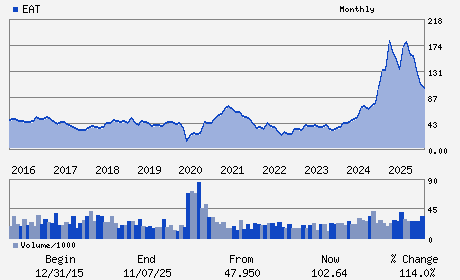

| • Price / Volume Information |

| Yesterday's Closing Price: $148.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,285,555 shares |

| Shares Outstanding: 43.55 (millions) |

| Market Capitalization: $6,454.16 (millions) |

| Beta: 1.34 |

| 52 Week High: $187.12 |

| 52 Week Low: $100.30 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-6.04% |

-5.21% |

| 12 Week |

5.52% |

5.39% |

| Year To Date |

3.26% |

2.76% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Kevin D. Hochman - Chief Executive Officer and President

Joseph M. DePinto - Chairman

Michaela M. Ware - Executive Vice President and Chief Financial Offic

Cynthia L. Davis - Director

William T. Giles - Director

|

|

Peer Information

Brinker International, Inc. (BH)

Brinker International, Inc. (BUCA)

Brinker International, Inc. (BUNZQ)

Brinker International, Inc. (FRRG)

Brinker International, Inc. (CHEF.)

Brinker International, Inc. (BGMTQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-RESTRNTS

Sector: Retail/Wholesale

CUSIP: 109641100

SIC: 5812

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 43.55

Most Recent Split Date: 12.00 (1.50:1)

Beta: 1.34

Market Capitalization: $6,454.16 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.86 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $10.68 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 13.26% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |