| Zacks Company Profile for Eventbrite, Inc. (EB : NYSE) |

|

|

| |

| • Company Description |

| Eventbrite, Inc. offers a platform which allows users to provide online event planning services, as well as publishes, promotes and sells tickets through social networks and e-mails. Eventbrite, Inc. is based in San Francisco, United States.

Number of Employees: 748 |

|

|

| |

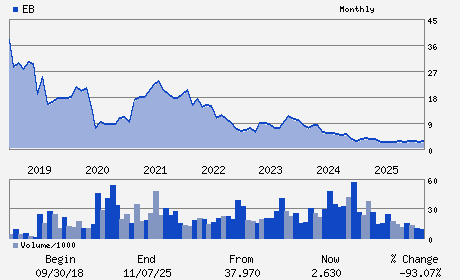

| • Price / Volume Information |

| Yesterday's Closing Price: $4.42 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,186,954 shares |

| Shares Outstanding: 97.68 (millions) |

| Market Capitalization: $431.72 (millions) |

| Beta: 1.39 |

| 52 Week High: $4.48 |

| 52 Week Low: $1.81 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.23% |

1.54% |

| 12 Week |

-0.23% |

-0.54% |

| Year To Date |

-0.67% |

-1.81% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Julia Hartz - Chief Executive Officer and Executive Chair

Anand Gandhi - Chief Financial Officer

Katherine August-deWilde - Director

Jane Lauder - Director

Pilar Manchon - Director

|

|

Peer Information

Eventbrite, Inc. (BIZZ)

Eventbrite, Inc. (DCLK)

Eventbrite, Inc. (DGIN.)

Eventbrite, Inc. (DVW)

Eventbrite, Inc. (CYCHZ)

Eventbrite, Inc. (IFXC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SERVICES

Sector: Computer and Technology

CUSIP: 29975E109

SIC: 7370

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/26/26

|

|

Share - Related Items

Shares Outstanding: 97.68

Most Recent Split Date: (:1)

Beta: 1.39

Market Capitalization: $431.72 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.03 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.05 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/26/26 |

|

|

|

| |