| Zacks Company Profile for Equitable Holdings, Inc. (EQH : NYSE) |

|

|

| |

| • Company Description |

| Equitable Holdings, Inc. is a financial services holding company comprised of two franchises, Equitable and AllianceBernstein. Equitable provides advice, protection and retirement strategies to individuals, families and small businesses. AllianceBernstein is a global investment management firm that offers research and diversified investment services to institutional investors, individuals and private wealth clients in major world markets.

Number of Employees: 8,000 |

|

|

| |

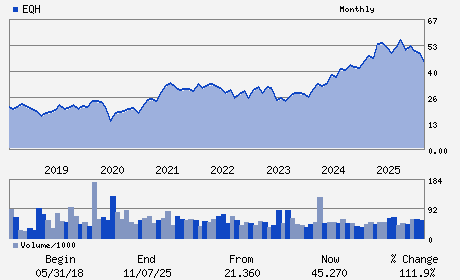

| • Price / Volume Information |

| Yesterday's Closing Price: $40.22 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,331,797 shares |

| Shares Outstanding: 280.35 (millions) |

| Market Capitalization: $11,275.59 (millions) |

| Beta: 1.12 |

| 52 Week High: $56.57 |

| 52 Week Low: $39.36 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-13.32% |

-12.56% |

| 12 Week |

-12.28% |

-12.39% |

| Year To Date |

-15.59% |

-16.00% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Mark Pearson - President;Chief Executive Officer and Director

Joan M. Lamm-Tennant - Chairman

Robin M. Raju - Chief Financial Officer

William Eckert - Chief Accounting Officer

Francis Hondal - Director

|

|

Peer Information

Equitable Holdings, Inc. (RDN)

Equitable Holdings, Inc. (AIG)

Equitable Holdings, Inc. (ACGI)

Equitable Holdings, Inc. (TXSC)

Equitable Holdings, Inc. (PTVCB)

Equitable Holdings, Inc. (PTVCA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INS-MULTI LINE

Sector: Finance

CUSIP: 29452E101

SIC: 6411

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 280.35

Most Recent Split Date: (:1)

Beta: 1.12

Market Capitalization: $11,275.59 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.69% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.79 |

Indicated Annual Dividend: $1.08 |

| Current Fiscal Year EPS Consensus Estimate: $7.71 |

Payout Ratio: 0.19 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: 0.03 |

| Estmated Long-Term EPS Growth Rate: 16.63% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |