| Zacks Company Profile for EZCORP, Inc. (EZPW : NSDQ) |

|

|

| |

| • Company Description |

| Ezcorp Inc. is engaged in establishing, acquiring, and operating pawnshops which function as convenient sources of consumer credit and as value-oriented specialty retailers of primarily previously owned merchandise. Through its lending function, the company makes relatively small, non-recourse loans secured by pledges of tangible personal property. The company contracts for a pawn service charge to compensate it for each pawn loan.

Number of Employees: 8,500 |

|

|

| |

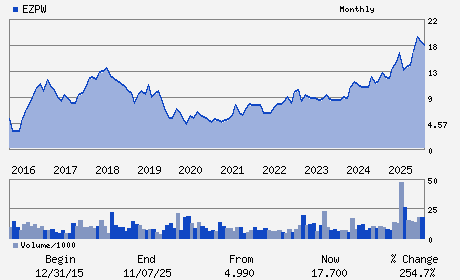

| • Price / Volume Information |

| Yesterday's Closing Price: $26.53 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,208,906 shares |

| Shares Outstanding: 61.70 (millions) |

| Market Capitalization: $1,636.82 (millions) |

| Beta: 0.53 |

| 52 Week High: $26.48 |

| 52 Week Low: $12.85 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

25.79% |

27.44% |

| 12 Week |

32.58% |

32.16% |

| Year To Date |

36.61% |

34.70% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Lachlan P. Given - Chief Executive Officer and Director

Phillip E. Cohen - Executive Chairman

Timothy K. Jugmans - Chief Financial Officer

Michael Croney - Chief Accounting Officer

Matthew W. Appel - Director

|

|

Peer Information

EZCORP, Inc. (EZPW)

EZCORP, Inc. (FPLPY)

EZCORP, Inc. (FMACQ)

EZCORP, Inc. (ASFI)

EZCORP, Inc. (ACAR.)

EZCORP, Inc. (HI.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-CONS LOANS

Sector: Finance

CUSIP: 302301106

SIC: 5900

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/27/26

|

|

Share - Related Items

Shares Outstanding: 61.70

Most Recent Split Date: 12.00 (3.00:1)

Beta: 0.53

Market Capitalization: $1,636.82 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.36 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.80 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/27/26 |

|

|

|

| |