| Zacks Company Profile for Diamondback Energy, Inc. (FANG : NSDQ) |

|

|

| |

| • Company Description |

| Diamondback Energy, Inc. is an independent oil and gas exploration & production company, with its primary focus on the Permian Basin. The upstream operator focuses on growth through a combination of acquisitions and active drilling in America's hottest and lowest-cost shale region. The Permian `Super' BasinA sedimentary basin lying underneath the western part of Texas and the south-eastern part of New Mexico.

Number of Employees: 1,762 |

|

|

| |

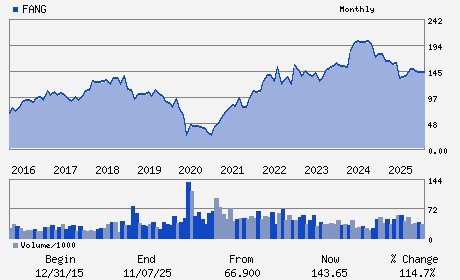

| • Price / Volume Information |

| Yesterday's Closing Price: $174.08 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,218,836 shares |

| Shares Outstanding: 282.08 (millions) |

| Market Capitalization: $49,104.31 (millions) |

| Beta: 0.59 |

| 52 Week High: $177.25 |

| 52 Week Low: $114.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.18% |

7.11% |

| 12 Week |

9.76% |

9.63% |

| Year To Date |

15.80% |

15.24% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Kaes Van't Hof - Chief Executive Officer and Director

Travis D. Stice - Executive Chairman of the Board and Director

Jere W. Thompson III - Chief Financial Officer; Executive Vice President

Teresa L. Dick - Chief Accounting Officer; Executive Vice President

Darin G. Holderness - Director

|

|

Peer Information

Diamondback Energy, Inc. (AEGG)

Diamondback Energy, Inc. (CHAR)

Diamondback Energy, Inc. (CECX.)

Diamondback Energy, Inc. (DLOV)

Diamondback Energy, Inc. (WACC)

Diamondback Energy, Inc. (DVN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL-US EXP&PROD

Sector: Oils/Energy

CUSIP: 25278X109

SIC: 1311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 282.08

Most Recent Split Date: (:1)

Beta: 0.59

Market Capitalization: $49,104.31 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.30% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.17 |

Indicated Annual Dividend: $4.00 |

| Current Fiscal Year EPS Consensus Estimate: $9.33 |

Payout Ratio: 0.33 |

| Number of Estimates in the Fiscal Year Consensus: 12.00 |

Change In Payout Ratio: 0.12 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |