| Zacks Company Profile for Full House Resorts, Inc. (FLL : NSDQ) |

|

|

| |

| • Company Description |

| Full House develops and manages gaming facilities. The Company has a management agreement with the Nottawaseppi Huron Band of Potawatomi Indians for the development and management of a first-class casino/resort with gaming devices in the Battle Creek, Michigan area, which is currently in the pre-development stage. Full House also manages Midway Slots and Simulcast at the Delaware State Fairgrounds in Harrington, Delaware, along with the owner of the adjacent racetrack.

Number of Employees: 2,010 |

|

|

| |

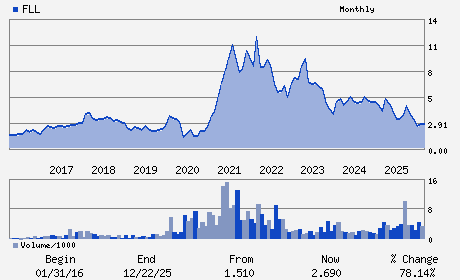

| • Price / Volume Information |

| Yesterday's Closing Price: $2.24 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 125,879 shares |

| Shares Outstanding: 36.12 (millions) |

| Market Capitalization: $81.09 (millions) |

| Beta: 1.40 |

| 52 Week High: $5.04 |

| 52 Week Low: $2.15 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-6.07% |

-4.84% |

| 12 Week |

-17.16% |

-17.42% |

| Year To Date |

-13.98% |

-11.93% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Daniel R. Lee - Chief Executive Officer

Lewis A. Fanger - Chief Financial Officer

Carl G. Braunlich - Director

Eric J. Green - Director

Lynn M. Handler - Director

|

|

Peer Information

Full House Resorts, Inc. (CHLD.)

Full House Resorts, Inc. (FGRD)

Full House Resorts, Inc. (CGMI.)

Full House Resorts, Inc. (AGAM.)

Full House Resorts, Inc. (ASCA.)

Full House Resorts, Inc. (BYD)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: GAMING

Sector: Consumer Discretionary

CUSIP: 359678109

SIC: 7011

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 36.12

Most Recent Split Date: (:1)

Beta: 1.40

Market Capitalization: $81.09 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |