| Zacks Company Profile for Gaia, Inc. (GAIA : NSDQ) |

|

|

| |

| • Company Description |

| Gaia, Inc. provides digital video subscription service. Its video content is available through online digital streaming on virtually any Internet-connected device on a commercial-free basis. The Company's subscribers access to a library of films, personal growth-related content, documentaries, interviews, yoga classes and fitness. It created a fitness and yoga-focused version of its video service. Gaia, Inc., formerly known as Gaiam Inc., is based in Louisville, United States.

Number of Employees: 104 |

|

|

| |

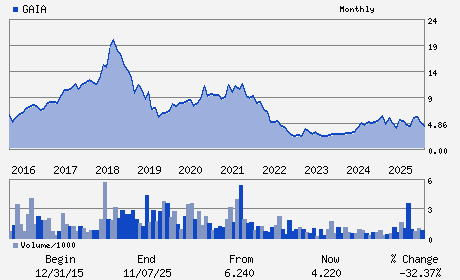

| • Price / Volume Information |

| Yesterday's Closing Price: $3.39 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 63,277 shares |

| Shares Outstanding: 25.11 (millions) |

| Market Capitalization: $85.12 (millions) |

| Beta: 0.93 |

| 52 Week High: $6.39 |

| 52 Week Low: $2.93 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.00% |

0.87% |

| 12 Week |

-3.97% |

-4.08% |

| Year To Date |

-6.61% |

-7.06% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

833 WEST BOULDER ROAD

-

LOUISVILLE,CO 80027

USA |

ph: 303-222-3600

fax: 303-222-3445 |

investors@gaia.com |

http://www.gaia.com |

|

|

| |

| • General Corporate Information |

Officers

James Colquhoun - Chief Executive Officer and Director

Jirka Rysavy - Chairman and Director

Ned Preston - Chief Financial Officer

Kristin Frank - Director

Keyur Patel - Director

|

|

Peer Information

Gaia, Inc. (DGIT)

Gaia, Inc. (T.CGO)

Gaia, Inc. (SIRI)

Gaia, Inc. (CETV)

Gaia, Inc. (SSP)

Gaia, Inc. (ANTVY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BRDCST-RADIO/TV

Sector: Consumer Discretionary

CUSIP: 36269P104

SIC: 7812

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/02/26

|

|

Share - Related Items

Shares Outstanding: 25.11

Most Recent Split Date: (:1)

Beta: 0.93

Market Capitalization: $85.12 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.06 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.12 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 25.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/02/26 |

|

|

|

| |