| Zacks Company Profile for GameSquare Holdings, Inc. (GAME : NSDQ) |

|

|

| |

| • Company Description |

| GameSquare Esports Inc. is a vertically integrated, international digital media and entertainment company enabling global brands to connect and interact with gaming and esports fans. It owns a portfolio of companies including Code Red Esports Ltd., an esports talent agency serving the UK, GCN, a digital media company focusing on the gaming and esports audience based in Los Angeles, USA., NextGen Tech, LLC esports organization operating in the United States, Swingman LLC a gaming and lifestyle marketing agency based in Los Angeles, USA, Fourth Frame Studios, a multidisciplinary creative production studio, and Mission Supply, a merchandise and consumer products business. GameSquare Esports Inc., formerly known as Engine Gaming and Media Inc., is headquartered in Toronto, Canada.

Number of Employees: 132 |

|

|

| |

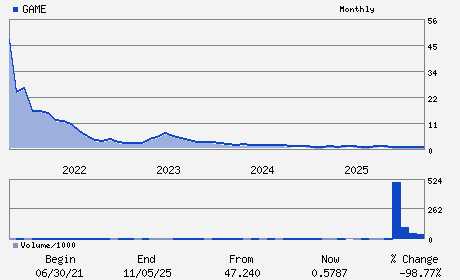

| • Price / Volume Information |

| Yesterday's Closing Price: $0.33 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,166,130 shares |

| Shares Outstanding: 98.38 (millions) |

| Market Capitalization: $32.04 (millions) |

| Beta: 0.79 |

| 52 Week High: $2.87 |

| 52 Week Low: $0.26 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-14.47% |

-13.72% |

| 12 Week |

-33.49% |

-33.57% |

| Year To Date |

-15.40% |

-15.81% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Justin Kenna - Chief Executive Officer and Director

Michael Munoz - Chief Financial Officer

Stuart Porter - Director

Tom Walker - Director

Travis Goff - Director

|

|

Peer Information

GameSquare Holdings, Inc. (CHLD.)

GameSquare Holdings, Inc. (FGRD)

GameSquare Holdings, Inc. (CGMI.)

GameSquare Holdings, Inc. (AGAM.)

GameSquare Holdings, Inc. (ASCA.)

GameSquare Holdings, Inc. (BYD)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: GAMING

Sector: Consumer Discretionary

CUSIP: 36468G103

SIC: 7900

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 04/21/26

|

|

Share - Related Items

Shares Outstanding: 98.38

Most Recent Split Date: 4.00 (0.25:1)

Beta: 0.79

Market Capitalization: $32.04 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.03 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.05 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/21/26 |

|

|

|

| |