| Zacks Company Profile for Greif, Inc. (GEF : NYSE) |

|

|

| |

| • Company Description |

| Greif Inc. is a leading global producer of industrial packaging products and services with operations across countries. It offers a comprehensive line of rigid industrial packaging products, like steel, fibre and plastic drums, rigid intermediate bulk containers, closure systems for industrial packaging products, transit protection products, water bottles and remanufactured and reconditioned industrial containers, and services, such as container life cycle management, filling, logistics, warehousing and other packaging services. The company produces and sells containerboard, corrugated sheets, corrugated containers and other corrugated products to customers in industries such as packaging, automotive, food and building products, coated & uncoated recycled paperboard and recycled fiber. Greif is a leading global producer of flexible intermediate bulk containers and related services. It sells timber to third parties and from time to time, timberland and special use land.

Number of Employees: 14,000 |

|

|

| |

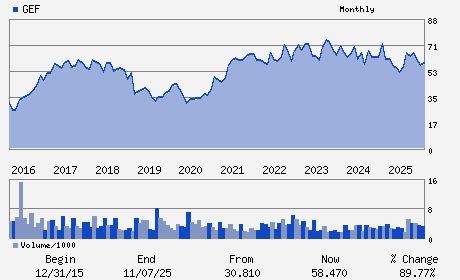

| • Price / Volume Information |

| Yesterday's Closing Price: $72.67 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 211,673 shares |

| Shares Outstanding: 46.29 (millions) |

| Market Capitalization: $3,363.60 (millions) |

| Beta: 0.95 |

| 52 Week High: $77.14 |

| 52 Week Low: $48.23 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.90% |

3.80% |

| 12 Week |

11.03% |

10.89% |

| Year To Date |

7.34% |

6.82% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ole G. Rosgaard - Chief Executive Officer;President and Director

Bruce A. Edwards - Chairman and Director

Lawrence A. Hilsheimer - Executive Vice President and Chief Financial Offic

Michael J. Taylor - Vice President; Corporate Financial Controller

B. Andrew Rose - Director

|

|

Peer Information

Greif, Inc. (AEPI)

Greif, Inc. (WFF)

Greif, Inc. (AMCR)

Greif, Inc. (AMCRY)

Greif, Inc. (GEF)

Greif, Inc. (DSGR.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CONTNRS-PPR/PLS

Sector: Industrial Products

CUSIP: 397624107

SIC: 3412

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 46.29

Most Recent Split Date: 4.00 (2.00:1)

Beta: 0.95

Market Capitalization: $3,363.60 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.08% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.24 |

Indicated Annual Dividend: $2.24 |

| Current Fiscal Year EPS Consensus Estimate: $4.20 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 31.07% |

Last Dividend Paid: 12/18/2025 - $0.56 |

| Next EPS Report Date: - |

|

|

|

| |