| Zacks Company Profile for Gildan Activewear, Inc. (GIL : NYSE) |

|

|

| |

| • Company Description |

| Gildan Activewear Inc. is a manufacturer and marketer of premium quality branded basic activewear for sale principally into the wholesale imprinted activewear segment of the North American apparel market. The company sells premium quality 100% cotton T-shirts and premium quality sweatshirts, in a variety of weights, sizes, colors and styles, as blanks, which are ultimately decorated with designs and logos for sale to consumers.

Number of Employees: 50,000 |

|

|

| |

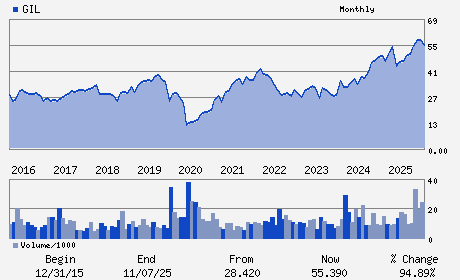

| • Price / Volume Information |

| Yesterday's Closing Price: $68.09 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,291,607 shares |

| Shares Outstanding: 185.17 (millions) |

| Market Capitalization: $12,608.41 (millions) |

| Beta: 1.05 |

| 52 Week High: $73.70 |

| 52 Week Low: $37.16 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.79% |

5.70% |

| 12 Week |

15.82% |

15.68% |

| Year To Date |

9.01% |

8.48% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

600 DE MAISONNEUVE WEST 33RD FLOOR

-

MONTREAL,A8 H3A 3J2

CAN |

ph: 514-735-2023

fax: 514-735-6810 |

investors@gildan.com |

https://gildancorp.com |

|

|

| |

| • General Corporate Information |

Officers

Glenn J. Chamandy - President and Chief Executive Officer

Rhodri J. Harries - Executive Vice-President; Chief Financial and Admi

Ghislain Houle - Director

Michael Kneeland - Director

Michener Chandlee - Director

|

|

Peer Information

Gildan Activewear, Inc. (DLWI)

Gildan Activewear, Inc. (DNKYQ)

Gildan Activewear, Inc. (CYDS)

Gildan Activewear, Inc. (GOSHA)

Gildan Activewear, Inc. (JLMCQ)

Gildan Activewear, Inc. (FUNW)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TEXTILE-APPAREL

Sector: Consumer Discretionary

CUSIP: 375916103

SIC: 2300

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 185.17

Most Recent Split Date: 3.00 (2.00:1)

Beta: 1.05

Market Capitalization: $12,608.41 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.33% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.90 |

| Current Fiscal Year EPS Consensus Estimate: $4.25 |

Payout Ratio: 0.26 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |