| Zacks Company Profile for GoPro, Inc. (GPRO : NSDQ) |

|

|

| |

| • Company Description |

| GoPro is one of the leading manufacturers of the world's most handy camera and enabler of some of today's most immersive and engaging content. GoPro manufactures mountable and wearable capture devices such as action cameras and related accessories. Its core product is the HERO line of capture devices.The company offers cloud connected HERO7 Silver, HERO7 Black, and HERO8 Black waterproof cameras, and MAX, a 360-degree waterproof camera, GoPro Plus, a cloud-based storage solution that enables subscribers to access, edit, and share content. It also offers mounts and accessories comprising equipment-based mounts consisting of helmet, handlebar, roll bar, and tripod mounts that enable consumers to wear the mount on their bodies, such as wrist housings, chest harnesses, and head straps. In addition, GoPro provides advanced software solutions to enhance its core offerings such as GoPro Studio, GoPro App, among others.

Number of Employees: 696 |

|

|

| |

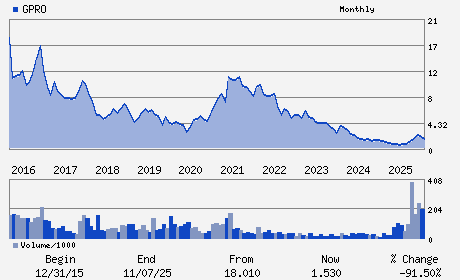

| • Price / Volume Information |

| Yesterday's Closing Price: $0.97 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,426,665 shares |

| Shares Outstanding: 159.73 (millions) |

| Market Capitalization: $154.58 (millions) |

| Beta: 1.72 |

| 52 Week High: $3.05 |

| 52 Week Low: $0.40 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-20.02% |

-18.97% |

| 12 Week |

-47.40% |

-47.57% |

| Year To Date |

-31.36% |

-39.02% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Nicholas Woodman - Chief Executive Officer and Chairman

Brian McGee - Chief Operating Officer and Chief Financial Office

Tyrone Ahmad-Taylor - Director

Kenneth Goldman - Director

Peter Gotcher - Director

|

|

Peer Information

GoPro, Inc. (HAR)

GoPro, Inc. (GTMM)

GoPro, Inc. (VPGC)

GoPro, Inc. (SANYY)

GoPro, Inc. (SONY)

GoPro, Inc. (KOSS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AUDIO/VIDEO PRD

Sector: Consumer Discretionary

CUSIP: 38268T103

SIC: 3861

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 159.73

Most Recent Split Date: (:1)

Beta: 1.72

Market Capitalization: $154.58 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.06 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.05 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |