| Zacks Company Profile for The Goldman Sachs Group, Inc. (GS : NYSE) |

|

|

| |

| • Company Description |

| The Goldman Sachs Group, Inc. is a leading global financial holding company providing IB, securities, investment management and consumer banking services to a diversified client base. It has 4 broad segments. The IB segment comprises the Financial Advisory, Underwriting and lending to corporate clients. The Global Markets segment comprises Fixed Income, Currency and Commodities, which include client-execution activities related to making markets in credit products, interest rate products, mortgages, currencies and commodities. Equities include client execution activities related to making markets in equities, commissions and fees, and its securities services business, warehouse lending & structured financing to institutional clients, advisory and underwriting assignments. The Consumer & Wealth Management segment includes management and other fees, incentive fees and results from deposit-taking activities related to wealth management business. The Asset Management division comprises management and other fees.

Number of Employees: 46,500 |

|

|

| |

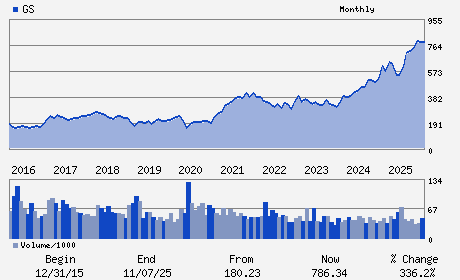

| • Price / Volume Information |

| Yesterday's Closing Price: $859.57 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,286,469 shares |

| Shares Outstanding: 296.75 (millions) |

| Market Capitalization: $255,079.97 (millions) |

| Beta: 1.34 |

| 52 Week High: $984.70 |

| 52 Week Low: $439.38 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-8.57% |

-7.37% |

| 12 Week |

2.60% |

2.27% |

| Year To Date |

-2.21% |

4.72% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

David Solomon - Chairman; Chief Executive Officer and Director

Denis P. Coleman III - Chief Financial Officer

Sheara J. Fredman - Chief Accounting Officer

M. Michele Burns - Director

Mark A. Flaherty - Director

|

|

Peer Information

The Goldman Sachs Group, Inc. (HDHL)

The Goldman Sachs Group, Inc. (AGE.)

The Goldman Sachs Group, Inc. (DIR)

The Goldman Sachs Group, Inc. (SIEB)

The Goldman Sachs Group, Inc. (OPY)

The Goldman Sachs Group, Inc. (FFGI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-INVEST BKRS

Sector: Finance

CUSIP: 38141G104

SIC: 6211

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/13/26

|

|

Share - Related Items

Shares Outstanding: 296.75

Most Recent Split Date: (:1)

Beta: 1.34

Market Capitalization: $255,079.97 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.86% |

| Current Fiscal Quarter EPS Consensus Estimate: $16.11 |

Indicated Annual Dividend: $16.00 |

| Current Fiscal Year EPS Consensus Estimate: $56.60 |

Payout Ratio: 0.31 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: 14.39% |

Last Dividend Paid: 12/02/2025 - $4.00 |

| Next EPS Report Date: 04/13/26 |

|

|

|

| |