| Zacks Company Profile for The Hackett Group, Inc. (HCKT : NSDQ) |

|

|

| |

| • Company Description |

| The Hackett Group, a global strategic advisory firm and an Answerthink company, is a leader in best practice research and advisory programs, benchmarking and transformation consulting services, including shared services, offshoring and outsourcing advice. Utilizing best practices and implementation insight from more than 4,000 benchmarking studies, executives use Hackett's empirically based approach to quickly define and prioritize initiatives, and to leverage proven strategies that enable world-class performance.

Number of Employees: 1,478 |

|

|

| |

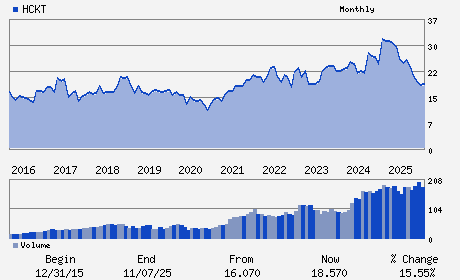

| • Price / Volume Information |

| Yesterday's Closing Price: $13.66 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 331,468 shares |

| Shares Outstanding: 27.13 (millions) |

| Market Capitalization: $370.61 (millions) |

| Beta: 1.06 |

| 52 Week High: $30.50 |

| 52 Week Low: $12.76 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-25.15% |

-24.50% |

| 12 Week |

-29.70% |

-29.78% |

| Year To Date |

-30.41% |

-30.75% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1001 BRICKELL BAY DRIVE SUITE 3000

-

MIAMI,FL 33131

USA |

ph: 305-375-8005

fax: 305-379-8810 |

None |

http://www.thehackettgroup.com |

|

|

| |

| • General Corporate Information |

Officers

Ted A. Fernandez - Chief Executive Officer and Chairman

Robert A. Ramirez - Executive Vice President; Finance and Chief Financ

David N. Dungan - Chief Operating Officer and Director

Richard Hamlin - Director

Robert A. Rivero - Director

|

|

Peer Information

The Hackett Group, Inc. (CEB)

The Hackett Group, Inc. (ACCL)

The Hackett Group, Inc. (EFX)

The Hackett Group, Inc. (NCI.)

The Hackett Group, Inc. (TGISQ)

The Hackett Group, Inc. (EXPO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Consulting

Sector: Business Services

CUSIP: 404609109

SIC: 8742

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 27.13

Most Recent Split Date: (:1)

Beta: 1.06

Market Capitalization: $370.61 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.51% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.28 |

Indicated Annual Dividend: $0.48 |

| Current Fiscal Year EPS Consensus Estimate: $1.38 |

Payout Ratio: 0.59 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.16 |

| Estmated Long-Term EPS Growth Rate: 11.00% |

Last Dividend Paid: 12/23/2025 - $0.12 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |