| Zacks Company Profile for Hudson Technologies, Inc. (HDSN : NSDQ) |

|

|

| |

| • Company Description |

| Hudson Technologies, Inc. is a leading provider of innovative solutions to recurring problems within the refrigeration industry. Hudson's proprietary RefrigerantSide Services increase operating efficiency and energy savings, and remove moisture, oils and other contaminants frequently found in the refrigeration circuits of large comfort cooling and process refrigeration systems. Performed at a customer's site as an integral part of an effective scheduled maintenance program or in response to emergencies, RefrigerantSide Services offer significant savings to customers due to their ability to be completed rapidly and at higher purity levels, and can be utilized while the customer's system continues to operate. In addition, the Company sells refrigerants and provides traditional reclamation services to the commercial and industrial air conditioning and refrigeration markets.

Number of Employees: 238 |

|

|

| |

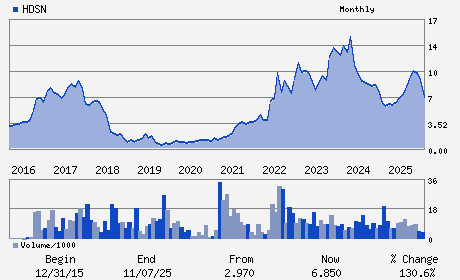

| • Price / Volume Information |

| Yesterday's Closing Price: $7.11 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 242,063 shares |

| Shares Outstanding: 43.00 (millions) |

| Market Capitalization: $305.75 (millions) |

| Beta: 0.92 |

| 52 Week High: $10.52 |

| 52 Week Low: $5.11 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.84% |

0.03% |

| 12 Week |

-2.74% |

-2.86% |

| Year To Date |

3.80% |

3.29% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Brian F. Coleman - Chief Executive Officer; President and Chairman

Brian J. Bertaux - Chief Financial Officer

Vincent P. Abbatecola - Director

Nicole Bulgarino - Director

Kathleen L. Houghton - Director

|

|

Peer Information

Hudson Technologies, Inc. (BOOM)

Hudson Technologies, Inc. (AMBIQ)

Hudson Technologies, Inc. (DSGR)

Hudson Technologies, Inc. (MSM)

Hudson Technologies, Inc. (SIEGY)

Hudson Technologies, Inc. (MATTQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Industrial Services

Sector: Industrial Products

CUSIP: 444144109

SIC: 5080

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/04/26

|

|

Share - Related Items

Shares Outstanding: 43.00

Most Recent Split Date: (:1)

Beta: 0.92

Market Capitalization: $305.75 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.44 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/04/26 |

|

|

|

| |