| Zacks Company Profile for Heron Therapeutics, Inc. (HRTX : NSDQ) |

|

|

| |

| • Company Description |

| Heron Therapeutics Inc. is a specialty pharmaceutical company. The company is developing products using its proprietary Biochronomer (TM) polymer-based drug delivery platform. Its product portfolio includes APF530, is being developed for the prevention of acute chemotherapy-induced nausea and vomiting. Heron Therapeutics Inc., formerly known as A.P. Pharma, Inc., is based in REDWOOD CITY CA.

Number of Employees: 128 |

|

|

| |

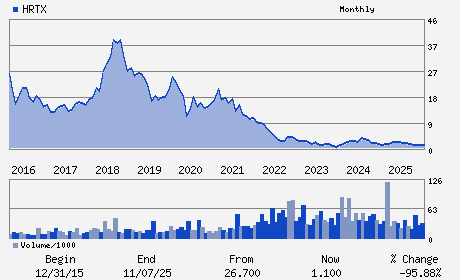

| • Price / Volume Information |

| Yesterday's Closing Price: $1.19 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,664,082 shares |

| Shares Outstanding: 188.54 (millions) |

| Market Capitalization: $224.36 (millions) |

| Beta: 1.26 |

| 52 Week High: $2.68 |

| 52 Week Low: $1.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-9.85% |

-9.06% |

| 12 Week |

-9.16% |

-9.27% |

| Year To Date |

-8.46% |

-8.91% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

100 REGENCY FOREST DRIVE SUITE 300

-

CARY,NC 27518

USA |

ph: 858-251-4400

fax: 650-365-6490 |

info@herontx.com |

http://www.herontx.com |

|

|

| |

| • General Corporate Information |

Officers

Craig Collard - Chief Executive Officer and Director

Adam Morgan - Chairman

Ira Duarte - Executive Vice President; Chief Financial Officer

Tom Cusack - Director

Sharmila Dissanaike - Director

|

|

Peer Information

Heron Therapeutics, Inc. (GSAC)

Heron Therapeutics, Inc. (CASIF)

Heron Therapeutics, Inc. (ALCD.)

Heron Therapeutics, Inc. (OMNN)

Heron Therapeutics, Inc. (CGPI.)

Heron Therapeutics, Inc. (CATX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-DRUGS

Sector: Medical

CUSIP: 427746102

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 188.54

Most Recent Split Date: 1.00 (0.05:1)

Beta: 1.26

Market Capitalization: $224.36 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.02 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.05 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |